Lisa Ortega operates Ortega Riding Academy. The academy??s primary sources of revenue are riding fees and lesson

Question:

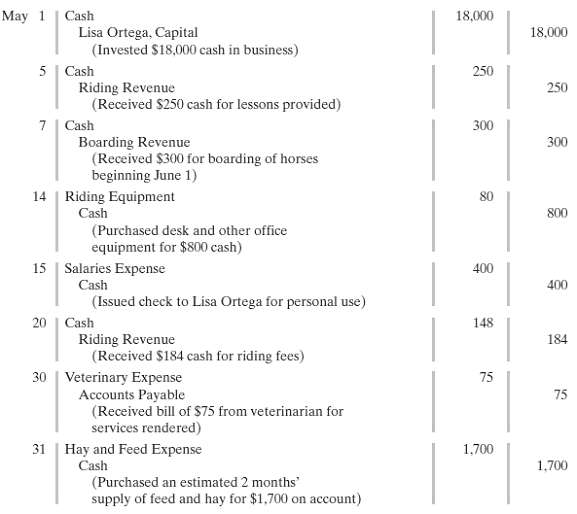

Lisa Ortega operates Ortega Riding Academy. The academy??s primary sources of revenue are riding fees and lesson fees, which are paid on a cash basis. Lisa also boards horses for owners, who are billed monthly for boarding fees. In a few cases, boarders pay in advance of expected use. For its revenue transactions, the academy maintains the following accounts:No. 1 Cash,No. 5 Boarding Accounts Receivable,No. 27 Unearned Boarding Revenue,No. 51 Riding Revenue,No. 52 Lesson Revenue, andNo. 53 Boarding Revenue. The academy owns 10 horses, a stable, a riding corral, riding equipment, and office equipment. These assets are accounted for in accountsNo. 11 Horses, No. 12 Building,No. 13 Riding Corral,No. 14 Riding Equipment, andNo. 15 Office Equipment. For its expenses, the academy maintains the following accounts:No. 6 Hay and Feed Supplies,No. 7 Prepaid Insurance,No. 21 Accounts Payable,No. 60 Salaries Expense,No. 61 Advertising Expense,No. 62 Utilities Expense,No. 63 Veterinary Expense,No. 64 Hay and Feed Expense, andNo. 65 Insurance Expense. Lisa makes periodic withdrawals of cash for personal living expenses. To record Lisa??s equity in the business and her drawings, two accounts are maintained:No. 50 Lisa Ortega, Capital, andNo. 51 Lisa Ortega, Drawing. During the first month of operations an inexperienced bookkeeper was employed. Lisa Ortega asks you to review the following eight entries of the 50 entries made during the month. In each case, the explanation for the entry is correct.

InstructionsWith the class divided into groups, answer the following.(a) Identify each journal entry that is correct. For each journal entry that is incorrect, prepare the entry that should have been made by the bookkeeper.(b) Which of the incorrect entries would prevent the trial balance from balancing?(c) What was the correct net income for May, assuming the bookkeeper reported net income of $4,500 after posting all 50 entries?(d) What was the correct cash balance at May 31, assuming the bookkeeper reported a balance of $12,475 after posting all 50 entries (and the only errors occurred in the items listedabove)?

Step by Step Answer:

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso