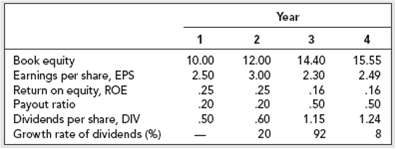

Look again at the financial forecasts for Growth-Tech given in Table 4.3. This time assume you know

Question:

Look again at the financial forecasts for Growth-Tech given in Table 4.3. This time assume you know that the opportunity cost of capital is r = .12 (discard the .099 figure calculated in the text). Assume you do not know Growth-Tech's stock value. Otherwise follow the assumptions given in the text.

a. Calculate the value of Growth-Tech stock.

b. What part of that value reflects the discounted value of P3, the price forecasted for year 3?

c.What part of P3 reflects the present value of growth opportunities (PVGO) after year 3?

d. Suppose that competition will catch up with Growth-Tech by year 4, so that it can earn only its cost of capital on any investments made in year 4 or subsequently. What is Growth-Tech stock worth now under this assumption? (Make additional assumptions ifnecessary.)

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers