Lundy Manufacturing produces and sells football equipment. The company was involved in the following transactions or events

Question:

Lundy Manufacturing produces and sells football equipment. The company was involved in the following transactions or events during 2012:

1. The company purchased $250,000 worth of materials to be used during 2013 to manufacture helmets and shoulder pads.

2. The company sold football equipment for $500,000. The inventory associated with the sale cost the company $375,000.

3. One of the company's plants in San Francisco was damaged by a minor earthquake. The total amount of the damage was $100,000.

4. The company issued ten ($l,000 face value) bonds at a discount (.98).

5. The company incurred $143,000 in wage expenses.

6. The company was sued by a high school football player who was injured while using some of the company's equipment. The football player will probably win the suit, and the amount of the settlement has been estimated at $10,000. This is the sixth lawsuit filed against the company in the past three years.

7. The company switched from the double-declining-balance depreciation method to the straight-line depreciation method.

8. The company declared and paid $50,000 in dividends.

9. The company incurred a loss when it sold some securities that it was holding as an investment.

Required

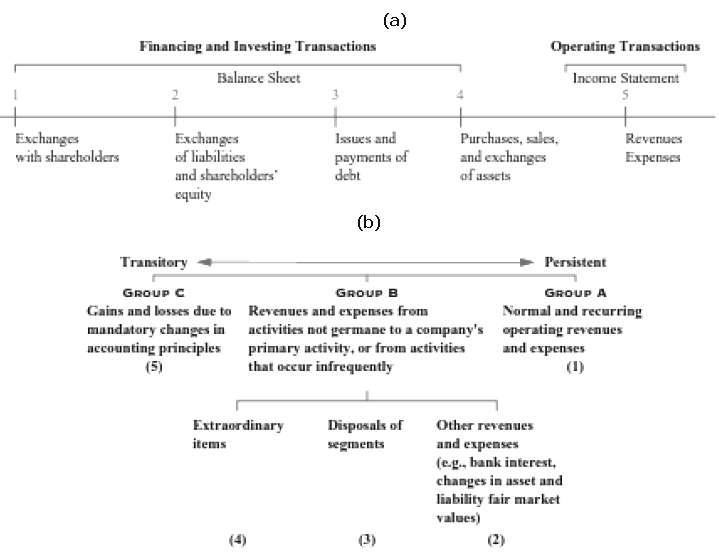

(a) Classify each of these transactions as financing, investing, or operating.

(b) Refer to Figures (a) and (b) in the text, and identify the category in which each of the items listed should be placed.

(c) Which of these items should be included on the company's income statement? Briefly describe how they should be disclosed

Step by Step Answer: