Mackey Company acquired equipment on January 1, 2011, through a leasing agreement that required an annual payments

Question:

Mackey Company acquired equipment on January 1, 2011, through a leasing agreement that required an annual payments of $30,000. Assume that the lease has a term of five year and that the life of the equipment is also five years. The lease is treated as a capital lease, and the FMV of the equipment is $119,781. Mackey uses the straight-line method to depreciated its fixed assets. The effective annual interest rate on the lease is 8 percent.

Required:

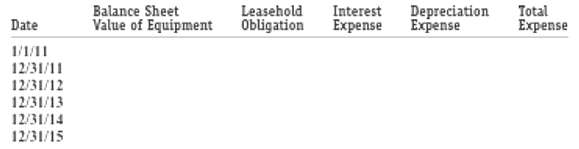

(a) Compute the amounts that would complete the table:

(b) Compute rent expense for 2011-2015 if the lease is treated as an operating lease.(c) Compute total expense over the five-year period under the two methods and comment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: