Answered step by step

Verified Expert Solution

Question

1 Approved Answer

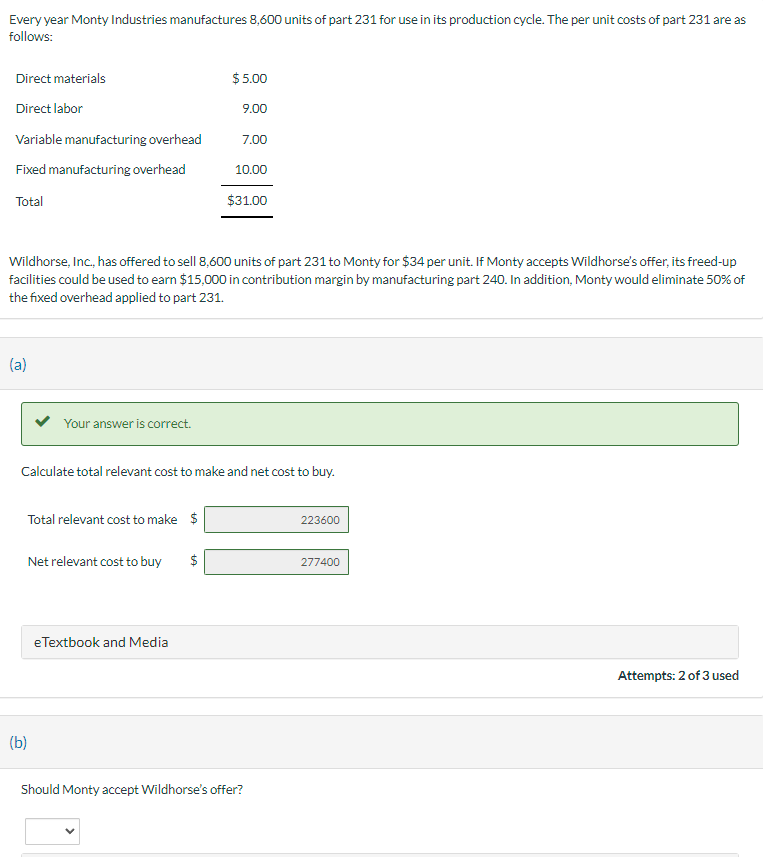

Every year Monty Industries manufactures 8,600 units of part 231 for use in its production cycle. The per unit costs of part 231 are

Every year Monty Industries manufactures 8,600 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total $5.00 9.00 7.00 10.00 $31.00 Wildhorse, Inc., has offered to sell 8,600 units of part 231 to Monty for $34 per unit. If Monty accepts Wildhorse's offer, its freed-up facilities could be used to earn $15,000 in contribution margin by manufacturing part 240. In addition, Monty would eliminate 50% of the fixed overhead applied to part 231. (a) Your answer is correct. Calculate total relevant cost to make and net cost to buy. (b) Total relevant cost to make $ 223600 Net relevant cost to buy $ 277400 eTextbook and Media Should Monty accept Wildhorse's offer? Attempts: 2 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the calculator in the image the total relevant cost to make is 223600 and the net relevant cost to buy is 277400 Should Monty accept Wildhorses offer No based on the net relevant cost it appe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started