Answered step by step

Verified Expert Solution

Question

1 Approved Answer

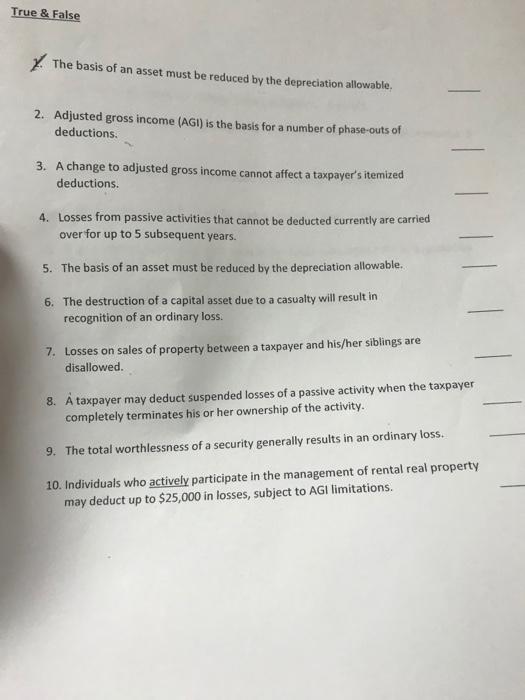

True & False The basis of an asset must be reduced by the depreciation allowable, 2. Adjusted gross income (AGI) is the basis for

True & False The basis of an asset must be reduced by the depreciation allowable, 2. Adjusted gross income (AGI) is the basis for a number of phase-outs of deductions. 3. A change to adjusted gross income cannot affect a taxpayer's itemized deductions. 4. Losses from passive activities that cannot be deducted currently are carried over for up to 5 subsequent years. 5. The basis of an asset must be reduced by the depreciation allowable.. 6. The destruction of a capital asset due to a casualty will result in recognition of an ordinary loss. 7. Losses on sales of property between a taxpayer and his/her siblings are disallowed. 8. A taxpayer may deduct suspended losses of a passive activity when the taxpayer completely terminates his or her ownership of the activity. 9. The total worthlessness of a security generally results in an ordinary loss. 10. Individuals who actively participate in the management of rental real property may deduct up to $25,000 in losses, subject to AGI limitations.

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 The basis of an asset must be reduced by the depreciation allowable Answer True The basis of an asset must be reduced by the depreciation allowable True If the taxpayer fails to take depreciation th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started