McEntire Corporation began operations on January 1, 2009. During its first 3 years of operations, McEntire reported

Question:

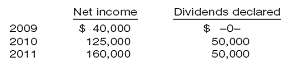

McEntire Corporation began operations on January 1, 2009. During its first 3 years of operations, McEntire reported net income and declared dividends as follows.

The following information relates to 2012.Income before income tax $220,000Prior period adjustment: understatement of 2010 depreciation expense (before taxes) $ 25,000Cumulative decrease in income from change in inventory methods (before taxes) $ 45,000Dividends declared (of this amount, $25,000 will be paid on January 15, 2013) $100,000Effective tax rate 40%Instructions(a) Prepare a 2012 retained earnings statement for McEntire Corporation.(b) Assume McEntire restricted retained earnings in the amount of $70,000 on December 31, 2012. After this action, what would McEntire report as total retained earnings in its December 31, 2012, balancesheet?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer: