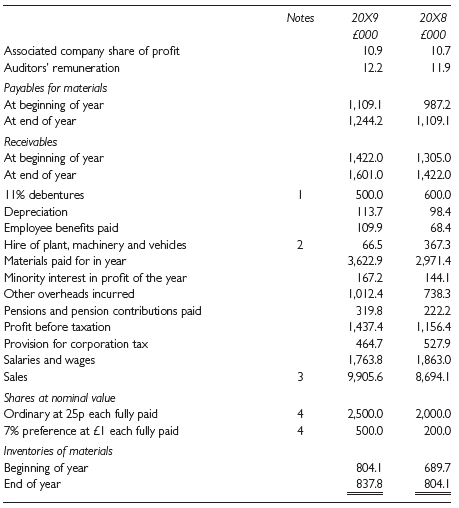

The following information relates to the Plus Factors Group plc for the years to 30 September 20X8 and 20X9: Ordinary dividends were declared as follows:

Ordinary dividends were declared as follows:

Interim 1.12 pence per share (20X8, l.67p)

Final 3.57 pence per share (20X8, 2.61p)

Average number of employees was 196 (20X8, 201)

Notes:

1 £300,000 of debentures were redeemed at par on 31 March 20X9 and £200,000 new debentures at the same rate of interest were issued at £98 for each £100 nominal value on the same date. The new debentures are due to be redeemed in five years€™ time.

2 This is the amount for inclusion in the statement of comprehensive income.

3 All the groups€™ sales are subject to value added tax at 15% and the figures given include such tax. All other figures are exclusive of value added tax. This VAT rate has been increased to 17.5% and may be subject to future changes, but for the purposes of this question the theory and workings remain the same irrespective of the rate.

4 All shares have been in issue throughout the year.

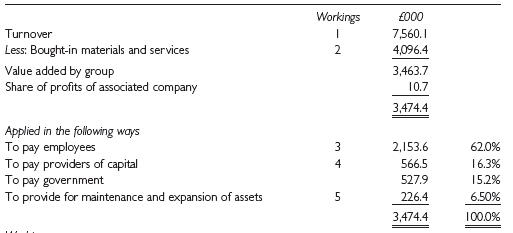

The statement of value added is available for 20X8 and the 20X9 statement needs to be completed.

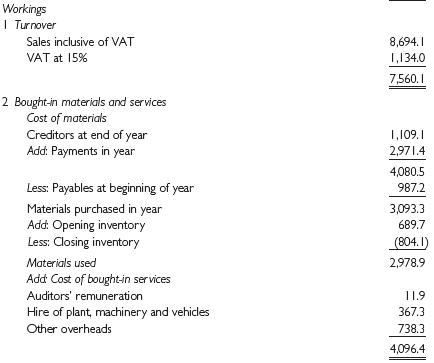

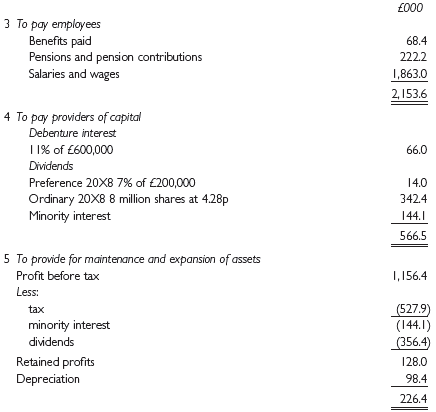

Working

Required:

(a) Prepare a statement of value added for the year to 30 September 20X9. Include a percentage breakdown of the distribution of value added.

(b) Produce ratios related to employees€™ interests based on the statement in (a) and explain how they might be of use.

(c) Explain briefly what the difficulties are of measuring and reporting financial information in the form of a statement of value added.

Notes 20X9 20X8 000 000 Associated company share of profit 10.9 10.7 Auditors' remuneration 12.2 11.9 Payables for materials At beginning of year At end of year I, 109.1 1,244.2 987.2 I, 109.1 Receivables At beginning of year At end of year 1,422.0 1,305.0 1,601.0 1,422.0 11% debentures 500.0 600.0 Depreciation Employee benefits paid Hire of plant, machinery and vehides Materials paid for in year Minority interest in profit of the year 113.7 98.4 109.9 68.4 2 66.5 367.3 3,622.9 2,971.4 167.2 144.1 Other overheads incurred 1,012.4 738.3 222.2 Pensions and pension contributions paid 319.8 1,156.4 Profit before taxation 1,437.4 Provision for corporation tax Salaries and wages 464.7 527.9 1,763.8 1,863.0 Sales 9,905.6 8,694.1 Shares at nominal value Ordinary at 25p each fully paid 7% preference at l each fully paid 4 2,500.0 2,000.0 500.0 200.0 4 Inventories of materials Beginning of year End of year 804.1 689.7 837.8 804.1

Step by Step Solution

3.34 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a Value added statement for year ended 30 September 20X9 20X9 20X8 000 000 Turnover 86136 75601 Boug... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 1 attachment)

168-B-A-G-F-A (1198).docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards