Molly Company manufactures both standard and customized electrical control boards for automated manufacturing machinery. The company recently

Question:

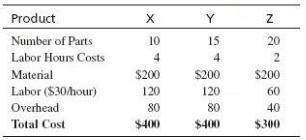

Molly Company manufactures both standard and customized electrical control boards for automated manufacturing machinery. The company recently completed installation of a robotic assembly unit. This automated unit completely eliminates direct labor in the production of several types of standard electrical control boards. Molly uses a job costing system. Boards usually are produced in batches of 10 to several hundred units. Over-head is applied to products based on direct labor hours. Sally Seed, the controller of Molly Company, recently met with Sam Nut, the production supervisor, concerning the cost of producing several of the firm’s products. The following discussion took place: Sam: “ Sally, I’m perplexed by your most recent cost figures for products X, Y, and Z, our big sellers. Before we installed the robotic assembly unit, the following data applied. Products X and Y had identical unit costs, and product Z was the cheapest to produce.” Sally: “That was correct, Sam. Our total budgeted overhead was $ 600,000. Given our expected

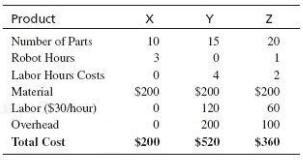

30,000 hours of direct labor, we had an applied overhead rate of $ 20 per direct labor hour. You can see, then, how these costs were calculated, as our direct labor costs were $ 30 per hour.” Sam: “According to your latest report, the first since we installed the new automated equipment, the following data apply.” “Sally, I’m not so sure that these cost representations are believable. We purchased

expensive automated equipment and overall eliminated almost a third of our labor cost, yet product Y, which does not use the new equipment, has increased more than 25% in cost. On the other hand, product X, which does use the new equipment, has decreased 50% in cost.” Sally: “Well Sam, our total budgeted overhead has increased to $ 1,000,000. But our expected hours of direct labor drop from 30,000 to 20,000. This gives an applied overhead rate of $ 50 per direct labor hour. You can see, then, how these costs were calculated, as our direct labor costs were $ 30 per hour.”

Well, that may be, Sally, but something just doesn’t make sense about using direct labor as the only allocation base for all overhead items. There are other things beside labor that increase production cost. Consider parts per product, for example. We spend a lot of effort in material handling, and it seems to me that more parts make more work, which means to me that it costs more.” Sally: “Sam, you may be right. I wanted to investigate activity- based costing, and this conversation has convinced me to do so. I’m going to collect some data and re-compute these cost figures using activity- based costing. I’ll get back to you soon, and we can see if these new figures seem to make more sense.”

Required

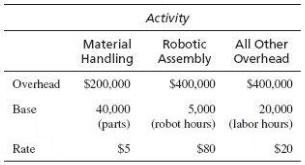

Sally collected the following data for ABC accounting.

a. Compute product costs under ABC using the three activities and their associated allocation bases shown here.

b. How might allocation bases for activity costs be identified?

Step by Step Answer:

Accounting Information Systems

ISBN: 9780132871938

11th Edition

Authors: George H. Bodnar, William S. Hopwood