(Multiple Choice) 1. From the following, select the two conditions that together will cause an entity to...

Question:

(Multiple Choice)

1. From the following, select the two conditions that together will cause an entity to be reported as a component unit of a primary government:

a. The primary government’s director of finance serves as a member of the entity’s governing body.

b. The primary government can appoint a voting majority of the entity’s governing body.

c. The primary government is required by law to finance the entity’s deficits.

d. The primary government is required by law to purchase its electricity from the entity, which also supplies electricity to the residents of the community.

e. The primary government is authorized by law to bill the entity for the cost of police and fire protection.

2. What items are compared in a budgetary comparison schedule for the General Fund?

a. Last year’s final budget; current year’s original budget; current year’s final budget

b. Last year’s final budget; current year’s final budget; current year’s actual inflows and out-flows on the budgetary basis of accounting

c. Current year’s original budget; current year’s final budget; current year’s actual inflows and outflows on the modified accrual basis of accounting

d. Current year’s original budget; current year’s final budget; current year’s actual inflows and outflows on the budgetary basis of accounting

3. Which of these items should be reported as “other financing uses” in a governmental funds statement of revenues, expenditures, and changes in fund balances?

a. Transfers out

b. Repayment of long- term debt principal

c. Capital outlays

d. Interest on long- term debt

4. Which of these items is normally reported as an “operating expense” in a proprietary fund statement of revenues, expenses, and changes in fund net position?

a. Interest expense on long- term debt

b. Transfers out

c. Repayment of long- term debt principal

d. Depreciation expense

5. In addition to the financial statements and notes, which two of the following items must be prepared to meet the minimum requirements for external financial reporting?

a. Statistical data

b. Management’s discussion and analysis

c. Combining statements for nonmajor funds

d. Required supplementary information

e. Schedules showing object- of- expenditure data for major departments or programs

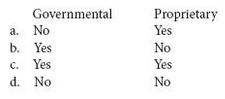

6. In fund financial statements, for which category/ categories of funds is depreciation reported?

.:.

7. For which of the following sets of funds is the modified accrual basis of accounting used for reporting in the fund financial statements?

a. Special Revenue Funds and Pension Trust Funds

b. Enterprise Funds and Internal Service Funds

c. General Fund and Debt Service Funds

d. All funds that meet the definition of major

8. How should the proceeds of debt be reported in a governmental fund’s statement of revenues, expenditures, and changes in fund balances?

a. As a revenue

b. As an “ other financing source”

c. As an extraordinary item

d. As an addition to the fund balance at the beginning of the period

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Introduction to Governmental and Not for Profit Accounting

ISBN: 978-0132776011

7th edition

Authors: Martin Ives, Terry K. Patton, Suesan R. Patton