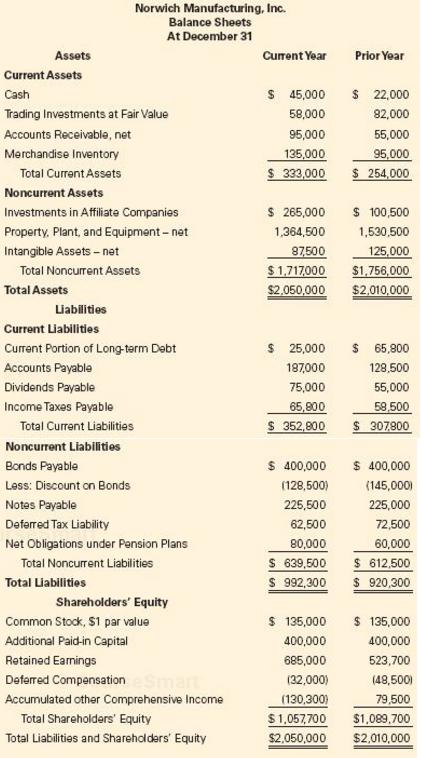

Norwich Manufacturing, Inc. provided you with the following comparative balance sheets and income statement. Norwich Manufacturing, Inc.

Question:

Norwich Manufacturing, Inc. provided you with the following comparative balance sheets and income statement.

Norwich Manufacturing, Inc.

Income Statement

For the Year Ended December 31

Current Year

Sales…………………………………………….. $ 2,433,244

Cost of Goods Sold…………………………........ 1,459,946

Gross Profit…………………………………......... $ 973,298

Selling, General, and Administrative Expenses….. $ 59,800

Pension Expense………………………………….. 260,510

Bad Debt Expense………………………………... 1,650

Depreciation Expense…………………………….. 19,470

Amortization Expense…………………………….. 7,425

Total Operating Expenses………………………… $ 348,855

Income before Interest and Taxes………………… $ 624,443

Interest Expense………………………………….. $ (55,110)

Interest Revenue 0 Investment Income

(includes Gain on Sale)…………………………... 55,000

Equity Earnings from Affiliate Companies………. 164,500

Income before Tax………………………………… $ 788,833

Income Tax Expense………………………………. (301,873)

Net Income………………………………………… $ 486,960

Additional Information:

1. Norwich sold investments with a cost of $ 55,000 at a gain of $ 40,500. It included this gain in investment income on the income statement.

2. The company acquired additional shares as investments to be carried at fair value. It accounted for all investments, other than investments carried under the equity method, as available-for-sale securities. It recorded a $ 9,000 unrealized loss for the current year.

3. The company reported accounts receivable net of the allowance for bad debts.

4. The company sold equipment at book value.

5. Norwich did not increase its percentage ownership of its equity investee (affiliate company).

6. Norwich sold one of its franchises at book value.

7. Norwich signed a $ 100,000 promissory note issued by an equipment dealer in the acquisition of a plant asset.

8. The company did not borrow additional cash funds during the year. 9. Treat trading investments as an investing activity.

Required

Prepare Norwich Manufacturing’s cash flow statement for the current year using the indirect method. Present required disclosures. DealerA dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella