Oakdale Fashions, Inc., had $245,000 in 2018 taxable income. Using the tax schedule in Table 2.3, calculate

Question:

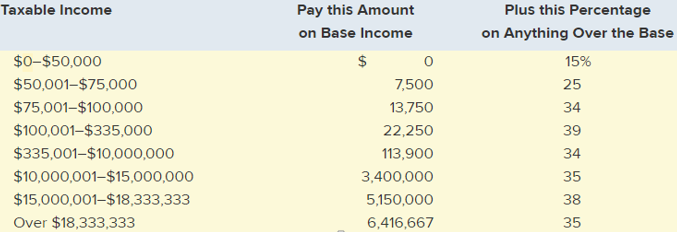

Oakdale Fashions, Inc., had $245,000 in 2018 taxable income. Using the tax schedule in Table 2.3, calculate the company's 2018income taxes. What is the average tax rate? What is the marginal tax rate?

Table 2.3 Corporate Tax Rates as of 2018

Transcribed Image Text:

Plus this Percentage on Anything Over the Base 15% 25 34 39 34 35 Taxable Income Pay this Amount on Base Income $0-$50,000 $50,001-$75,000 7,500 13,750 $75,001-$100,000 22,250 113,900 $100,001-$335,000 $335,001-$10,000,000 $10,000,001-$15,000,000 $15,000,001-$18,333,333 Over $18,333,333 3,400,000 5,150,000 38 35 6,416,667

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 69% (13 reviews)

From Table 23 the 245000 of taxable income puts Oakdale F...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Auditing questions

-

Oakdale Fashions, Inc., had $245,000 in 2015 taxable income. Using the tax schedule in Table, calculate the companys 2015 income taxes. What is the average tax rate? What is the marginal tax rate?

-

Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2015. In addition to $42.4 million of taxable income, the firm received $2,975,000 of interest on state-issued bonds and...

-

Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2018. In addition to $42.4 million of taxable income, the firm received $2,975,000 of interest on state-issued bonds and...

-

The data below are the calories and grams of sugar in some popular store bought cookies. Calories 143 Grams of Sugar 12 97 9 200 11 149 19 84 4 57 9 198 21

-

In the Assembly Department of Mantle Company, budgeted and actual manufacturing overhead costs for the month of April 2012 were as follows.. All costs are controllable by the department manager....

-

You expect to enroll in a four - year medical school six years from today, and you are planning accordingly. Current tuition for medical school is $ 6 1 , 0 0 0 per year, and it's is expected to grow...

-

8. For nongovernmental NFP, are gifts in kind always reported as unrestricted support that increases unrestricted net assets?

-

Name and briefly describe the five product mix pricing decisions.

-

A partial tabular summary for Cheyenne Corp. on July 31, 2017, includes the accounts below before adjustments have been prepared. Assets = Liabilities + Stockholders' Equity Invest. Prepd. Acc....

-

The Sentry Lock Corporation manufactures a popular commercial security lock at plants in Macon, Louisville, Detroit, and Phoenix. The per unit cost of production at each plant is $35.50, $37.50,...

-

The Fitness Studio, Inc.'s 2018 income statement lists the following income and expenses: EBIT = $773,500, interest expense = $100,000, and taxes = $234,500. The firm has no preferred stock...

-

Ramakrishnan Inc. reported 2018 net income of $15 million and depreciation of $2,650,000. The top part of Ramakrishnan, Inc.'s 2018 and 2017 balance sheets is listed below (in millions of dollars)....

-

What If the Facts Were Different? If Selheimer & Company had not had the authority to accept funds for investment, did not authorize its manager to accept such funds, and did not represent that the...

-

1. What does the phrase "cost of quality" mean? How might using this statement assist a company in addressing its quality issues? 2. What key distinctions exist between total quality human resource...

-

Does productivity in terms of output per labor our insure a company will be profitable? Why or why not? What questions should be asked to test whether productivity has increased? How do these answers...

-

How do the four Ps of marketing (product, price, promotion, place) differ in international markets?

-

Do you agree with the societal or political forces? Why or why not? Support your assertions with credible sources

-

How do the global transformational leadership models comprise a work environment that sees the need for change and embraces the new changes?Explain

-

Use an example of the Employee entity type to justify how a unary 1:N relationship works.

-

To help you become familiar with the accounting standards, this case is designed to take you to the FASBs Web site and have you access various publications. Access the FASBs Web site at...

-

You are considering a stock investment in one of two firms (AllDebt, Inc., and AllEquity, Inc.), both of which operate in the same industry and have identical operating income of $12.5 million....

-

You have been given the following information for Corkys Bedding Corp.: a. Net sales = $11,250,000 b. Cost of goods sold = $7,500,000; c. Other operating expenses = $250,000; d. Addition to retained...

-

You have been given the following information for Corkys Bedding Corp.: a. Net sales = $11,250,000 b. Cost of goods sold = $7,500,000; c. Other operating expenses = $250,000; d. Addition to retained...

-

What is Coke's average ownership percentage in its equity method investments? Goodwill is 7000 Calculate the firm's current ratio (current assets/current liabilities). Calculate the current ratio...

-

John has to choose between Project A and Project B, which are mutually exclusive. Project A has an initial cost of $30,000 and an internal rate of return of 16 percent. Project B has an initial cost...

-

Complete the table below, for the above transactions

Study smarter with the SolutionInn App