On January 1, 2010 Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale

Question:

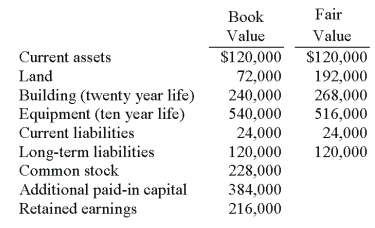

On January 1, 2010 Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop’s assets, liabilities, and stockholder’s equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

1. The 2010 total amortization of allocations is calculated to be?

a) $4,000

b) $6,400

c) ($2,400)

d) ($1,000)

e) $3,800

2. In Cale’s accounting records, what amount would appear on December 31, 2010 for equity in subsidiary earnings?

a) $77,000

b) $79,000

c) $125,000

d) $127,000

e) $81,800

3. What is the balance in Cale’s Investment in subsidiary account at the end of 2010?

a) $1,099,000

b) $1,020,000

c) $1,096,200

d) $1,098,000

e) $1,144,400

Step by Step Answer:

Financial Reporting and Analysis

ISBN: 978-0078025679

6th edition

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon