On January 1, 2011, Prado acquired 80% of the share capital of Lalli for $198,000. At this date, the equity of Lalli consisted of: Share

On January 1, 2011, Prado acquired 80% of the share capital of Lalli for $198,000. At this date, the equity of

Lalli consisted of:

Share capital .........$150,000

Retained earnings....... 50,000

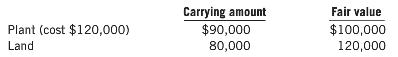

At January 1, 2011, all of Lalli€™s identiï¬able assets and liabilities were recorded at fair value except for the following assets:

The plant had a further ï¬ve-year life, with beneï¬ts expected to be received evenly over that period. The land was sold by Lalli in July 2013 for $150,000. Prado uses the partial goodwill method.

Financial information for these two companies at December 31, 2013, included:

-2.png)

Additional information:

1. During 2012, Lalli sold some inventory to Prado for $8,000. This inventory had originally cost Lalli $6,000. At December 31, 2012, 10% of these goods remained unsold by Prado.

2. The ending inventory of Prado included inventory sold to it by Lalli at a proï¬t of $3,000 before tax. This had cost Lalli $32,000.

3. On January 1, 2012, Lalli sold a plant to Prado for $50,000. This asset had a carrying value of $40,000. Prado depreciates it on a straight-line basis over a six-year period.

4. The tax rate is 30%.

5. Prado€™s share capital has always been $100,000.

6. On January 1, 2014, Prado sold 15% of its ownership in Lalli so that it now owns 65%. Prado received $20,000 for the shares.

Required

(a) Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b) Calculate the effect on consolidated equity in 2014 from the sale of shares.

(c) What would be the effect if Prado lost control at 65% ownership due to an agreement?

Plant (cost $120,000) Land Carrying amournt $90,000 80,000 Fair value $100,000 120,000 Prado $920,000 65,000 985,000 622,000 223,000 845,000 140,000 30,000 110,000 80,000 190,000 20,000 25,000 45,000 145,000 Lalli $780,000 82,000 862,000 580,000 162,000 742,000 120,000 40,000 80,000 88,000 168,000 30,000 20,000 50,000 $118,000 Sales revenue Other income Cost of sales Other expenses Income before tax Income tax expense Net income Retained earnings (1/1/13) Dividend paid Dividend declared Retained earnings (31/12/13)

Step by Step Solution

3.36 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Acquisition Analysis as at January 1 2011 Consideration transferred 198000 Net fair value of the identifiable Assets and liabilities of Lalli Share capital 150000 Retained earnings 50000 Plant 10000 1... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 1 attachment)

469-B-A-C (842).docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards