On January 4, 20X7, Pradeesh Corp. acquired 100% of the outstanding common shares of Serena Inc. by

Question:

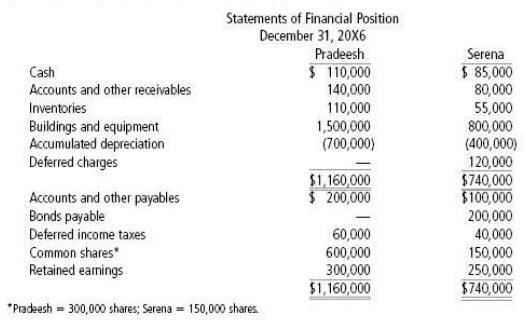

On January 4, 20X7, Pradeesh Corp. acquired 100% of the outstanding common shares of Serena Inc. by a share- for- share exchange of its own shares valued at $ 1,000,000 (P3– 8). The statements of financial position of both companies just prior to the share exchange are shown below. Serena had patents, not shown on the SFP that had an estimated fair value of $ 200,000 and an estimated remaining productive life of four years. Serena’s buildings and equipment had an estimated fair value $ 300,000 in excess of carrying value, and the deferred charges were assumed to have a fair value of zero. Serena’s buildings and equipment are being depreciated on the straight- line basis and have a remaining useful life of 10 years. The deferred charges are being amortized over three years.

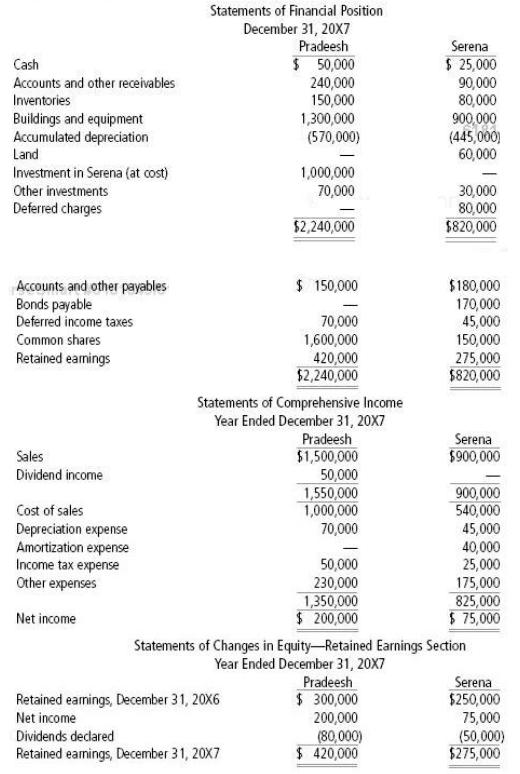

During 20X7, the year following the acquisition, Serena borrowed $ 100,000 from Pradeesh; $ 40,000 was repaid and $ 60,000 is still outstanding at year- end. No interest is being charged on the loan. Through the year, Serena sold goods to Pradeesh totaling $ 400,000. Serena’s gross margin is 40% of selling price, and its tax rate is 25%. Three- quarters of these goods were resold by Pradeesh to its customers for $ 450,000. Dividend declarations amounted to $ 80,000 by Pradeesh and $ 50,000 by Serena. There were no other intercompany transactions. The year- end 20X7 SFPs and SCIs for Pradeesh and Serena are shown below.

Required

a. How would the SCI and SFP for Pradeesh Corp. differs from those shown below if Pradeesh reported its investment in Serena on the equity basis? Show all calculations.

b. Prepare a complete set of consolidated financial statements for Pradeesh Corp. for 20X7.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay