On June 30, the end of the current fiscal year, the following information is available to Heart

Question:

On June 30, the end of the current fiscal year, the following information is available to Heart Company’s accountants for making adjusting entries:

a. One of the company’s liabilities is a mortgage payable in the amount of $520,000. On June 30, the accrued interest on this mortgage was $26,000.

b. On Friday, July 2, the company, which is on a five-day workweek and pays employees weekly, will pay its regular salaried employees $37,400.

c. On June 29, the company completed negotiations and signed a contract to provide services to a new client at an annual rate of $14,400.

d. The Supplies account shows a beginning balance of $3,230 and purchases during the year of $8,230. The end-of-year inventory reveals supplies on hand of $2,636.

e. The Prepaid Insurance account shows the following entries on June 30:

Beginning Balance …………………$3,240

January 1 ………………………….. 5,800

May 1 ……………………………... 6,732

The beginning balance represents the unexpired portion of a one-year policy purchased a year ago. The January 1 entry represents a new one-year policy; the May 1 entry represents the additional coverage of a three-year policy.

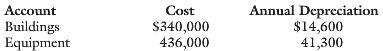

f. The following table contains the cost and annual depreciation for buildings and equipment, all of which were purchased before the current year:

g. On June 1, the company completed negotiations with another client and accepted a payment of $43,200, representing one year’s services paid in advance. The $43,200 was credited to Services Collected in Advance.

h. The company calculates that as of June 30, it had earned $9,000 on a $15,000 contract that will be completed and billed in August.

i. Federal income taxes for the year are estimated to be $12,600.

REQUIRED

1. Prepare adjusting entries for each item listed above.

2. Explain how the conditions for revenue recognition are applied to transactions c and h.

Step by Step Answer: