On May 1, a petty cash fund was established for $150.00. The following vouchers were issued during

Question:

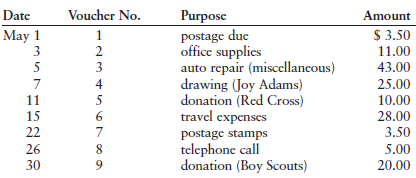

On May 1, a petty cash fund was established for $150.00. The following vouchers were issued during May:

REQUIRED

1. Prepare the journal entry to establish the petty cash fund.

2. Record the vouchers in the petty cash record. Total and rule the petty cash record.

3. Prepare the journal entry to replenish the petty cash fund. Make the appropriate entry in the petty cash record.

Transcribed Image Text:

Voucher No. Date Purposc Amount $ 3.50 postage due office supplies auto repair (miscellancous) drawing (Joy Adams) donation (Red Cross) travel expenses May 1 3 11.00 43.00 25.00 11 10.00 15 28.00 22 3.50 postage stamps telephone call donation (Boy Scouts) 26 5.00 20.00 30 1234 S670

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

1 2 and 3 DATE 20 May 1 Petty Cash GENERAL JOURNAL DESCRIPTION Cash Est...View the full answer

Answered By

Madhvendra Pandey

Hi! I am Madhvendra, and I am your new friend ready to help you in the field of business, accounting, and finance. I am a College graduate in B.Com, and currently pursuing a Chartered Accountancy course (i.e equivalent to CPA in the USA). I have around 3 years of experience in the field of Financial Accounts, finance and, business studies, thereby looking forward to sharing those experiences in such a way that finds suitable solutions to your query.

Thus, please feel free to contact me regarding the same.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting questions

-

On July 1, a petty cash fund was established for $100.00. The following vouchers were issued during July: REQUIRED 1. Prepare the journal entry to establish the petty cash fund. 2. Record the...

-

On July 1, a petty cash fund was established for S100.00. The following vouchers were issued during July: REQUIRED 1. Prepare the journal entry to establish the petty cash fund. 2. Record the...

-

On August 1, City Delivery creates a petty cash fund with a balance of $450. During August, Eva Unger, the fund custodian, signs the following petty cash tickets: On August 31, prior to...

-

Which of the following options are available for creating a policy in Qualys Policy Compliance? (Choose three) A, Create from Host B, Create from Scratch C, Import from Library D, Import from CSV File

-

Accounting records for Red Deer Tire Ltd. yield the following data for the year ended December 31, 2017 (amounts in thousands): Inventory, December 31,...

-

To be enforceable, every contract must include an offer and an acceptance. Consider a typical online retail transaction in which an item is ordered and paid for online by a purchaser and shipped by...

-

Proportion of false positives.

-

Cost allocation downward demand spiral Deli One operates a chain of 10 hospitals in the Los Angeles area. Its central food-catering facility, Deliman, prepares and delivers meals to the hospitals. It...

-

A clothing merchant purchases a shipment of clothes for $35,000.00 with discounts of 10.00% and 6.00%. He sells it to a customer at a price which includes 20.00% profit on selling price and overhead...

-

Ricks Bags manufactures both golf bags and tennis totes. Fixed manufacturing overhead is budgeted to be $ 187,200, variable manufacturing overhead is budgeted to be $ 1.10 per direct labor hour, and...

-

The book balance in the checking account of Lyles Salon as of November 30 is $3,282.95. The bank statement shows an ending balance of $2,127.00. By examining last months bank reconciliation,...

-

Listed below are the weekly cash register tape amounts for service fees and the related cash counts during the month of July. A change fund of $100.00 is maintained. REQUIRED 1. Prepare the journal...

-

Without considering the following capital gains and losses, Charlene, who is single, has taxable income of $660,000 and a marginal tax rate of 37%. During the year, she sold stock held for nine...

-

List and describe three common interview mistakes which compromise the quality of the selection process.

-

Player I chooses a positive integer x > 0 and player II chooses a positive integer y > 0. The player with the lower number pays a dollar to the player with the higher number unless the higher number...

-

1. Distinguish between risk management and risk transfer. As the manager of XYZ FBO, what measures would you put in place to ensure risk reduction?

-

Devlop a sumary of your understanding of Learning and Retention. In the sumary, think about how you see Learning and Retention fitting into the entire study of Organizational Behavior. How does the...

-

Emani, Peters and Desai et al (2018) "conducted a cross-sectional survey of adopters and non-adopters of the portal...the survey consisted of perceived attributes from the DOI theory,...

-

Would that have any effect on class dynamics?

-

What is the difference between adsorption and absorption?

-

Contrary to the predictions of welfare economics, people are willing to pay to have constraints place on themselves. Indicate whether each statement is true or false, and justify your answer.

-

From the worksheet in Exercise prepare the assets section of a classified balancesheet. G. JACKSON CO. WORKSHEET FOR YEAR ENDED DECEMBER 31, 201X Balance Sheet Income Statement Debit Account Credit...

-

From the worksheet in Exercise prepare the assets section of a classified balancesheet. G. JACKSON CO. WORKSHEET FOR YEAR ENDED DECEMBER 31, 201X Balance Sheet Income Statement Debit Account Credit...

-

On December 31, 2012, $330 of salaries has been accrued. (Salaries before the accrued amount totaled $28,500.) The next payroll to be paid will be on February 3, 2013, for $6,400. Please do the...

-

Aecerty 1067687 was completed with the folowing charaderistick Murulectere sec00 5xs:99 s35ida sputed

-

Assume todays settlement price on a CME EUR futures contract is $1.3180 per euro. You have a long position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond...

-

Q2. Company ABC bought an equipment for $20,000 in 2015, with useful life of 5 years $5,000 residual value amortized using straight-line method. Prepare a table to illustrate the differences...

Study smarter with the SolutionInn App