On September 30, 2014, when the market interest rate is 6 percent, Yale Ltd. Issues $8,000,000 of

Question:

On September 30, 2014, when the market interest rate is 6 percent, Yale Ltd. Issues $8,000,000 of 8-percent, 20-year bonds for $9,849,182. The bonds pay interest on March 31 and September 30. Yale Ltd. amortizes bond premium by the effective-interest method.

Required

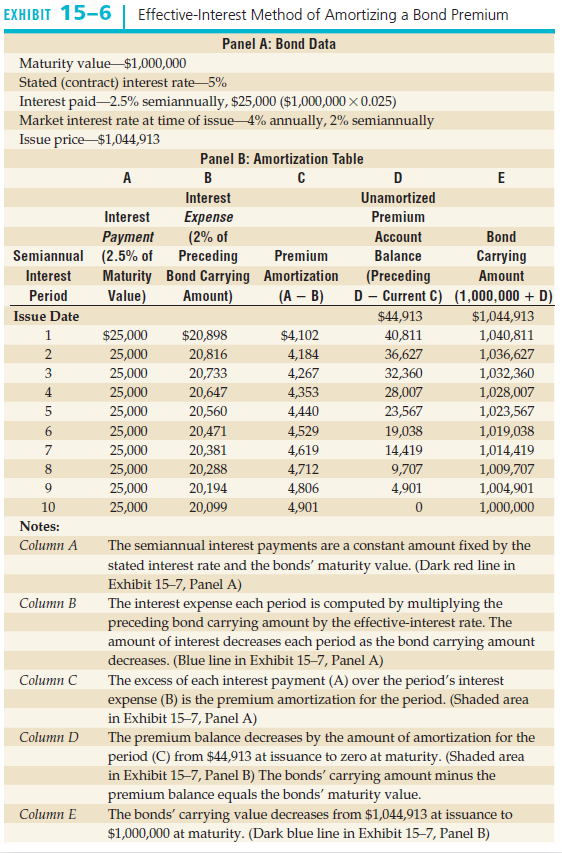

1. Prepare an amortization table for the first four semiannual interest periods. Follow the format of Panel B in Exhibit 15-6 on page 934.

2. Record the issuance of the bonds on September 30, 2014, the accrual of interest at December 31, 2014, and the semiannual interest payment on March 31, 2015.

EXHIBIT 15-6 Effective-Interest Method of Amortizing a Bond Premium Panel A: Bond Data Maturity value-$1,000,000 Stated (contract) interest rate 5% Interest paid-2.5% semiannually, $25,000 ($1,000,000 × 0.025) Market interest rate at time of issue 4% annually, 2% semiannually Issue price-$1,044,913 Panel B: Amortization Table A в Interest Unamortized Expense (2% of Preceding Maturity Bond Carrying Amortization Amount) Interest Premium Payment Semiannual (2.5% of Account Bond Premium Balance Carrying Interest (Preceding Amount D - Current C) (1,000,000 + D) (A – B) Period Value) Issue Date $44,913 $1,044,913 $20,898 $25,000 $4,102 40,811 36,627 32,360 1,040,811 4,184 25,000 20,816 1,036,627 25,000 3 20,733 4,267 1,032,360 1,028,007 4. 25,000 20,647 4,353 28,007 23,567 1,023,567 25,000 20,560 4,440 20,471 4,529 4,619 4,712 25,000 19,038 1,019,038 25,000 20,381 14,419 1,014,419 20,288 25,000 9,707 1,009,707 4,901 25,000 20,194 4,806 1,004,901 1,000,000 10 25,000 20,099 4,901 Notes: Column A The semiannual interest payments are a constant amount fixed by the stated interest rate and the bonds' maturity value. (Dark red line in Exhibit 15-7, Panel A) Column B The interest expense each period is computed by multiplying the preceding bond carrying amount by the effective-interest rate. The amount of interest decreases each period as the bond carrying amount decreases. (Blue line in Exhibit 15–7, Panel A) Column C The excess of each interest payment (A) over the period's interest expense (B) is the premium amortization for the period. (Shaded area in Exhibit 15-7, Panel A) Column D The premium balance decreases by the amount of amortization for the period (C) from $44,913 at issuance to zero at maturity. (Shaded area in Exhibit 15-7, Panel B) The bonds' carrying amount minus the premium balance equals the bonds' maturity value. The bonds' carrying value decreases from $1,044,913 at issuance to $1,000,000 at maturity. (Dark blue line in Exhibit 15-7, Panel B) Column E

Step by Step Answer:

1 Yale Ltd Amortization Table SEMIANNUAL INTEREST PERIOD A INTEREST PAYMENT 4 OF MATURITY VALUES B I...View the full answer

Accounting

ISBN: 978-0132690089

9th Canadian Edition volume 2

Authors: Charles T. Horngren, Walter T. Harrison Jr., Jo Ann L. Johnston, Carol A. Meissner, Peter R. Norwood

Students also viewed these Accounting questions

-

Playfair Sports Ltd. is authorized to issue $6,000,000 of 5-percent, 10-year bonds. On January 2, 2014, the contract date, when the market interest rate is 6 percent, the company issues $4,800,000 of...

-

Life Fitness Ltd. is authorized to issue $6,000,000 of 5 percent, 10-year bonds. On January 2, 2017, the contract date, when the market interest rate is 6 percent, the company issues $4,800,000 of...

-

On December 31, 2017, when the market interest rate is 6 percent, an investor purchases $700,000 of Solar Ltd. 10-year, 5 percent bonds at issuance for $647,929. Interest is paid semi-annually....

-

1. Rick and Barbara are married with two children. Four yearsago, Barbara bought a $75,000 life insurance policy on her motherslife and named her children as policy beneficiaries. Barbara didnot name...

-

What are some criteria that systems designers should consider when developing managerial reports for an AIS? Can you think of any others beyond those described in the chapter? If so, what are they?

-

Entertainment Electronics Company has two divisions, Video and Audio, and two corporate service departments, Computer Support and Accounts Payable. The corporate expenses for the year ended December...

-

(Basic Pension Worksheet) The following defined pension data of Doreen Corp. apply to the year 2011. Projected benefit obligation, 1/1/11 (before amendment) $560,000 Plan assets, 1/1/11 546,200...

-

1. Why did Tescos initial international expansion strategy focus on developing nations? 2. How does Tesco create value in its international operations? 3. In Asia, Tesco has a long history of...

-

Required information [The following information applies to the questions displayed below) Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list...

-

Consider the following two scenarios: Scenario I: Over the 20X120X5 period, Micro Systems, Inc., spends $10 million a year to develop patents on new computer hardware manufacturing technology. While...

-

Lafayette Corp. issues $1,500,000 of 20-year, 8-percent bonds on March 31, 2014. The bonds sell at 102.00 and pay interest on March 31 and September 30. Assume Lafayette Corp. amortizes the premium...

-

The following questions are not related. 1. IMAX Corporation obtains the use of most of its theatre properties through leases. IMAX Corporation prefers operating leases over capital leases. Why is...

-

Identify the tax issue or issues suggested by the following situations, and state each issue in the form of a question. Several years ago, Ferris Corporation purchased heavy machinery for $618,000....

-

1. (5 pts) Given y[n]= 2y[n-1] and y[0]=2, Write MATLAB code to calculate and plot y for 0

-

F ( t ) = t 4 + 1 8 t 2 + 8 1 2 , g ( t ) = ( t + 3 ) / 3 ; find ( f o g ) ( 9 )

-

How did they calculate allocated cost FLIGHT A FLIGHT 350 615 FLIGHT 3 1 Go GALS 20 G EXISTING SCHEME, DETERMINE THE OVE OR FLIGHTS A, B, AND C. 2 ED AT 7.00 PER K1.00 OF PILOT SALAF TOTAL NON-SALARY...

-

High Tech ManufacturingInc., incurred total indirect manufacturing labor costs of $540,000. The company is labor-intensive. Total labor hours during the period were 5,000. Using qualitativeanalysis,...

-

Start with AS/AD and IS/MP in full employment equilibrium. Assume the is a massive positive aggregate demand shock. How would this affect AS/AD and IS/MP and prices and output relative to the full...

-

It's important to understand how technology impacts a firm's strategy and competitive environment. Consider the description of Otis elevator's use of embedded systems. Which parts of the value chain...

-

In your readings, there were many examples given for nurturing close family relationships in this ever-evolving technological society we live in Based upon your readings and research describe three...

-

Brett Favre Repair Shop had the following transactions during the first month of business. Journalize the transactions. Aug. 2 Invested $12,000 cash and $2,500 of equipment in the business. 7...

-

On July 1, 2005, Blair Co. pays $18,000 to Hindi Insurance Co. for a 3-year insurance contract. Both companies have fiscal years ending December 31. For Blair Co. journalize the entry on July 1 and...

-

Using the data in BE3-3, journalize the entry on July 1 and the adjusting entry on December 31 for Hindi Insurance Co. Hindi uses the accounts Unearned Insurance Revenue and Insurance Revenue.

-

explain in excel please For a particular product the price per unit is $6. Calculate Revenue if sales in current period is 200 units. Conduct a data analysis, on revenue by changing the number of...

-

Hall Company sells merchandise with a one-year warranty. In the current year, sales consist of 35,000 units. It is estimated that warranty repairs will average $10 per unit sold and 30% of the...

-

Q 4- Crane Corporation, an amusement park, is considering a capital investment in a new exhibit. The exhibit would cost $ 167,270 and have an estimated useful life of 7 years. It can be sold for $...

Study smarter with the SolutionInn App