Question: Original activity-based costing, activity-based management (Adapted from CMA, June 1992) Alaire Corporation manufactures several different types of printed-circuit boards; however, two of the boards account

Original activity-based costing, activity-based management (Adapted from CMA, June 1992) Alaire Corporation manufactures several different types of printed-circuit boards; however, two of the boards account for the majority of the company's sales. The first of these boards, a TV circuit board, has been a standard in the industry for several years. The market for this type of board is competitive and, therefore, price sensitive. Alaire plans to sell 65,000 of the TV boards this year at a price of $1 150 per unit. The second high-volume product, a PC circuit board, is a recent addition to Alaires product line. Because the PC board incorporates the latest technology, it can be sold at a premium price; this year's plans include the sale of 40,000 PC boards at $300 per unit.

Alaires management group is meeting to discuss strategies for this year, and the current topic of conversation is how to spend the sales and promotion dollars for next year. The sales manager believes that the market share for the TV board could be expanded by concentrating Alaires promotional efforts in this area. In response to this suggestion, the production manager said, "Why don't you go after a bigger market for the PC board? The cost sheets that I get show that the contribution from the PC board is more than double the contribution from the TV board. I know we get a premium price for the PC board. Selling it should help overall profitability."

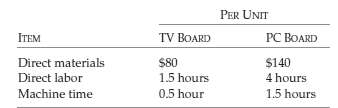

Alaire uses a standard cost system, and the following data apply to the TV and PC boards:

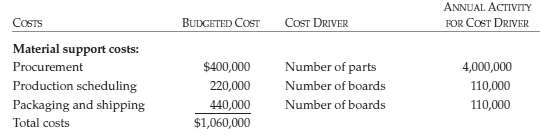

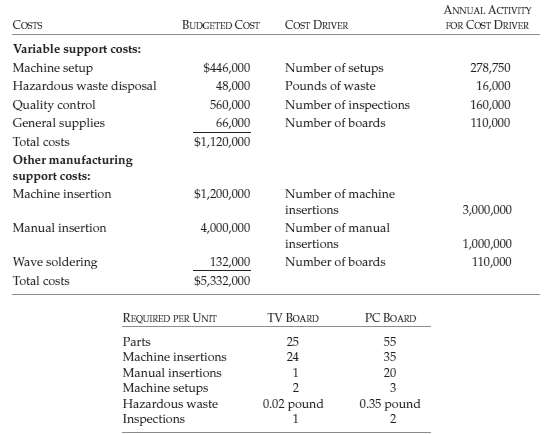

Direct labor cost is $14 per hour. Variable manufacturing support costs are applied on the basis of direct labor hours. This year's variable manufacturing support costs are budgeted at $1,120,000, and direct labor hours are estimated at 280,000. Other manufacturing support is applied at $10 per machine hour. Alaire applies a materials handling charge of 10% of materials cost; this materials handling charge is not included in variable manufacturing support costs. Total expenditures for materials this year are budgeted at $10,800,000.Ed Welch, Alaire's controller, believes that before the management group proceeds with the discussion about allocating sales and promotional dollars to individual products, it may be worthwhile to look at these products on the basis of the activities involved in their production. Welch has prepared the following schedules for the management group:

"Using this information," Welch explained, "we can calculate an activitybased cost for each TV board and each PC board and then compare it to the standard cost we have been using. The only cost that remains the same for both cost methods is the cost of direct materials. The cost drivers will replace the direct labor and support costs in the standard cost."Required(a) Identify at least four general advantages that are associated with activity-based costing.(b) On the basis of standard costs, calculate the total contribution expected this year for Alaire Corporation's products: the TV board and the PC board.(c) On the basis of activity-based costs, calculate the total contribution expected this year for Alaire Corporation's two products.(d) Explain how the comparison of the results of the two costing methods may impact the decisions made by Alaire Corporation's management group.

PER UNIT PC BOARD TV BOARD ITEM Direct materials Direct labor Machine time $140 $80 1.5 hours 4 hours 1.5 hours

Step by Step Solution

3.52 Rating (176 Votes )

There are 3 Steps involved in it

1 General advantages associated with activitybased costing include a Provides management with a more thorough understanding of complex product costs and product profitability for improved resource man... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

62-B-M-A-C-S-D (247).docx

120 KBs Word File