Pan Corporation acquired an 85 percent interest in Sly Corporation on August 1, 2011, for $522,750, equal

Question:

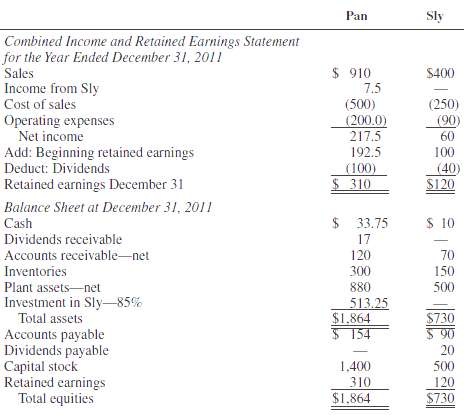

Pan Corporation acquired an 85 percent interest in Sly Corporation on August 1, 2011, for $522,750, equal to 85 percent of the underlying equity of Sly on that date. In August 2011, Sly sold inventory items to Pan for $60,000 at a gross profit of $15,000. Onethird of these items remained in Pan's inventory at December 31, 2011. On September 30, 2011, Pan sold an inventory item (equipment) to Sly for $50,000 at a gross profit to Pan of $10,000. When this equipment was placed in service by Sly, it had a five-year remaining useful life and no expected salvage value. Sly's dividends were declared in equal amounts on June 15 and December 15, and its income was earned in relatively-equal amounts throughout each quarter of the year. Pan applies the equity method, such that its net income is equal to the controlling share of consolidated net income. Financial statements for Pan and Sly are as follows (in thousands):

REQUIRED: Prepare a consolidation workpaper for the year ended December 31,2011.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith