Presented here are a statement of income and retained earnings and comparative balance sheets for Gallagher, Inc.,

Question:

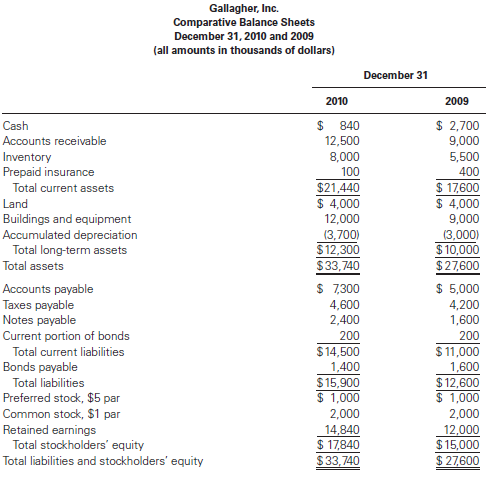

Presented here are a statement of income and retained earnings and comparative balance sheets for Gallagher, Inc., which operates a national chain of sporting goods stores.

Gallagher, Inc.

Statement of Income and Retained Earnings

For the Year Ended December 31, 2010

(all amounts in thousands of dollars)

Net sales ................$48,000

Cost of goods sold ............ 36,000

Gross profit ............... $ 12,000

Selling, general, and administrative expense .. 6,000

Operating income ..............$ 6,000

Interest expense .............. 280

Income before tax ..............$ 5,720

Income tax expense ............ 2,280

Net income ................$ 3,440

Preferred dividends ............. 100

Income available to common ..........$ 3,340

Common dividends ............. 500

To retained earnings ............$ 2,840

Retained earnings, 1/1 ............ 12,000

Retained earnings, 12/31 ........... $ 14,840

Required

1. Prepare a statement of cash flows for Gallagher, Inc., for the year ended December 31, 2010, using the indirect method in the Operating Activities section of the statement.

2. Gallagher’s management is concerned with its short-term liquidity and its solvency over the long run. To help management evaluate these, compute the following ratios, rounding all answers to the nearest one-tenth of a percent:

a. Current ratio

b. Acid-test ratio

c. Cash flow from operations to current liabilities ratio

d. Accounts receivable turnover ratio

e. Number of days’ sales in receivables

g. Number of days’ sales in inventory

h. Debt-to-equity ratio

i. Debt service coverage ratio

j. Cash flow from operations to capital expenditures ratio

3. Comment on Gallagher’s liquidity and its solvency. What additional information do you need to fully evaluate the company?

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial...

Step by Step Answer:

Using Financial Accounting Information The Alternative to Debits and Credits

ISBN: 978-1133161646

7th Edition

Authors: Gary A. Porter, Curtis L. Norton