R. Johnson inherited 810,000 £1 ordinary shares in Johnson Products Ltd on the death of his uncle

Question:

R. Johnson is planning to emigrate and is considering disposing of his shareholding. He has had approaches from three par ties, who are:

1 A competitor €“ Sonar Products Ltd. Sonar Products Ltd considers that Johnson Products Ltd would complement its own business and is interested in acquiring all of the 810,000 shares. Sonar Products Ltd currently achieves a post-tax return of 12.5% on capital employed.

2 Senior employees. Twenty employees are interested in making a management buyout with each acquiring 40,500 shares from R. Johnson. They have obtained financial backing, in principle, from the company€™s bankers.

3 A financial conglomerate €“ Divest plc. Divest plc is a company that has extensive experience of acquiring control of a company and breaking it up to show a profit on the transaction. It is its policy to seek a pre-tax return of 20% from such an exercise.

The company has prepared draft accounts for the year ended 30 April 20X9. The following information is available.

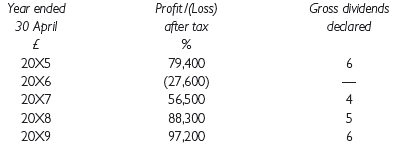

(a) Past earnings and distributions:

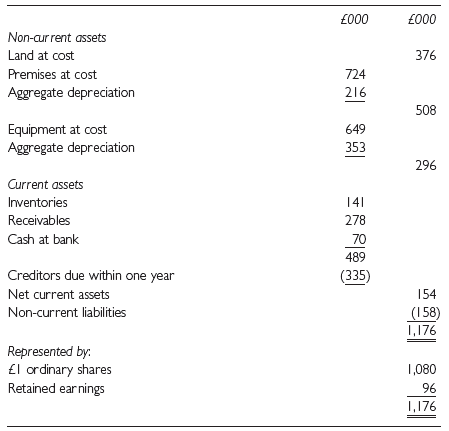

(b) Statement of financial position of Johnson Products Ltd as at 30 April 20X9:

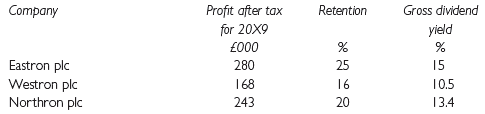

(c) Information on the nearest comparable listed companies in the same industry:

Profit after tax in each of the companies has been growing by approximately 8% per annum for the past five years.

(d) The following is an estimate of the net realizable values of Johnson Products Ltd€™s assets as at 30 April 20X9:

£000

Land ......... 480

Premises ......... 630

Equipment ....... 150

Receivables ..... 168

Inventories ....... 98

Required:

(a) As accountant for R. Johnson, advise him of the amount that could be offered for his shareholding with a reasonable chance of being acceptable to the seller, based on the information given in the question, by each of the following:

(i) Sonar Products Ltd;

(ii) The 20 employees;

(iii) Divest plc.

(b) As accountant for Sonar Products Ltd, estimate the maximum amount that could be offered by Sonar Products Ltd for the shares held by R. Johnson.

(c) As accountant for Sonar Products Ltd, state the principal matters you would consider in determining the future maintainable earnings of Johnson Products Ltd and explain theirrelevance.

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott