Refer again to question 9. Suppose that the continuously compounded return on Backwoods?s assets over the next

Question:

Refer again to question 9. Suppose that the continuously compounded return on Backwoods?s assets over the next year is normally distributed with a mean of 10 percent. What is the probability that Backwoods will default?

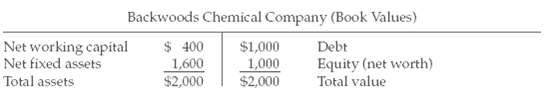

Look back to the first Backwoods Chemical example at the start of Section 24.5. Suppose that the firm?s book balance sheet is

The debt has a one-year maturity and a promised interest rate of 9 percent. Thus, the promised payment to Backwoods's creditors is $1,090. The market value of the assets is $1,200, and the standard deviation of asset value is 45 percent per year. The risk-free interest rate is 9 percent. Calculate the value of Backwoods debt and equity.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers