Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the projects NPV

Question:

Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the project’s NPV (round to nearest dollar)? Is the investment attractive? Why or why not?

Data from Short Exercise S26-4

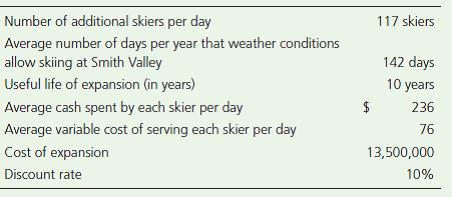

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valley’s managers developed the following estimates concerning the expansion:

Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its 10-year life.

Number of additional skiers per day 117 skiers Average number of days per year that weather conditions allow skiing at Smith Valley 142 days Useful life of expansion (in years) 10 years Average cash spent by each skier per day $ 236 Average variable cost of serving each skier per day 76 Cost of expansion 13,500,000 Discount rate 10%

Step by Step Answer:

Time Net Cash Inflow Annuity PV Factor i 10n 10 Present Value 1 10 years ...View the full answer

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valleys managers developed...

-

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $ 13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valleys managers developed...

-

Consider how Hunter Valley Snow Park Lodge could use capital budgeting to decide whether the $11,000,000 Snow Park Lodge expansion would be a good investment. Assume Hunter Valley's managers...

-

F udy A big part of communication is sharing personal information with another person. Some information we believe we have the right to be our own and should remain private. However, the degree to...

-

A molecular compound is composed of 60.4% Xe, 22.1% O, and 17.5% F, by mass. If the molecular weight is 217.3 amu, what is the molecular formula? What is the Lewis formula? Predict the molecular...

-

What advantage is derived from benchmarking against firms other than competitors?

-

Find the probability of randomly selecting an adult from the sample who does not prefer a science fiction movie or an action movie. SECTION 3.4 In Exercises 4144, perform the indicated calculation.

-

Munger.Com began operations on January 1, 2006. The company reports the following information about its investments at December 31, 2006: Required: a. Show how each of these investments are reported...

-

Exercise 10-5A (Algo) Calculations for a line of credit LO 10-2 Colson Company has a line of credit with Federal Bank. Colson can borrow up to $325,000 at any time over the course of the Year 1...

-

You are the paralegal for Public Defender social worker; you received a new case, a 12 year old girl, "Gee Gee:, who has been charged with several felony crimes, 2 counts of unlawful sexual contact...

-

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. What is the projects NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data from Short...

-

Using IRR to make capital investment decisions Refer to Short Exercise S26-4. Continue to assume that the expansion has no residual value. What is the projects IRR? Is the investment attractive? Why...

-

What is a company's cost of capital? How does it relate to the required rate of return on a capital expenditure? lop5

-

How have you maintained your medical billing skills over the past 12 months? Include any courses or learning opportunity you used to build your current knowledge base. How did these skills help you?...

-

1. What issues does Bob Holland face as he takes over as CEO of Ben & Jerry's? Which are the most important? 2. Where is the market headed? What are the competitive influences and compare the...

-

Do you think there is a difference between diversity management and affirmative action? Provide an explanation for your response. Support your response with APA cited references. Response: Diversity...

-

1. In what ways do practical and statistical significance work together to help us understand program effects? Can one be important to aprogram evaluator withoutthe other? If so, how? If not, why...

-

How do IT metrics, measurements, productivity, and efficiency work together? Make sure you explain each word.Make sure to pick out two or three specific IT data and measures. Also, back up what you...

-

Name the two types of procedures.

-

Ashlee, Hiroki, Kate, and Albee LLC each own a 25 percent interest in Tally Industries LLC, which generates annual gross receipts of over $10 million. Ashlee, Hiroki, and Kate manage the business,...

-

Compute the utilization for these task sets: a. P1: period = 1 s, execution time = 10 ms; P2: period = 100 ms, execution time 10 ms b. P1: period 100 ms, execution time = 25 ms; P2: period = 80 ms,...

-

Assume that Jump Coffee Shop completed the following periodic inventory transactions for a line of merchandise inventory: Requirements 1. Compute ending merchandise inventory, cost of goods sold, and...

-

Assume that Jump Coffee Shop completed the following periodic inventory transactions for a line of merchandise inventory: Requirements 1. Compute ending merchandise inventory, cost of goods sold, and...

-

Consider the data of the following companies which use the periodic inventory system: Requirements 1. Supply the missing amounts in the preceding table. 2. Prepare the income statement for the year...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

Study smarter with the SolutionInn App