Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. What is

Question:

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. What is the project’s NPV (round to nearest dollar)? Is the investment attractive? Why or why not?

Data from Short Exercise S26- 4.

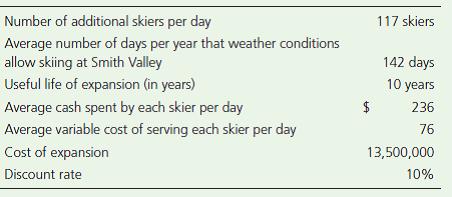

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valley’s managers developed the following estimates concerning the expansion:

Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its 10-year life.

Number of additional skiers per day 117 skiers Average number of days per year that weather conditions allow skiing at Smith Valley 142 days Useful life of expansion (in years) 10 years Average cash spent by each skier per day $ 236 Average variable cost of serving each skier per day 76 Cost of expansion 13,500,000 Discount rate 10%

Step by Step Answer:

Time Net Cash Inflow Annuity PV Factor i 10 n 10 PV Factor i 10 n 10 Present Value ...View the full answer

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

Refer to the Smith Valley Snow Park Lodge expansion project in S21-2. Requirement 1. Compute the payback period for the expansion project.

-

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valleys managers developed...

-

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4 and your calculations in Short Exercises S26- 5 and S26- 6. Assume the expansion has zero residual value. Data...

-

In each of the homeowners forms, OA) the property coverage is the same OB) the liability coverage varies OC) both the property and liability coverage are the same OD) the property coverage varies

-

Use the VSEPR method to predict the geometry of the following ion and molecules: a. ClO3; b. OF2; c. SiF4.

-

Prepare an REA model for the customer inquiry business process from the following amended version of the Horizon Books case. Horizon Books is a bookstore in downtown Philadelphia. It carries an...

-

Find the probability of randomly selecting an adult from the sample who does not prefer a comedy.

-

David and Sandra Dess contracted with Sirva Relocation, LLC, to assist in selling their home. In their contract, the Desses agreed to disclose all information about the property on which Sirva and...

-

Bogscraft Company has outstanding 6 1 , 5 0 0 shares of $ 1 0 par value common stock and 2 5 , 3 0 0 shares of $ 2 0 par value preferred stock ( 8 percent ) . On February 1 , the board of directors...

-

Ontario Industries manufactures two types of refrigerators, Olivia and Solta. Information on each refrigerator is as follows: The labour rates per hour for various activities are as follows: Design...

-

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose): 1. $ 8,750 per year at the end of each of the...

-

Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the projects NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data from Short Exercise...

-

On March 1, Laton Products (a U.S. firm) purchased manufacturing inputs from a Mexican supplier for 20,000 pesos, payable on June 1. The exchange rate for pesos on March 1 was \(\$ 0.17\). If the...

-

Identify at least two business systems that support the development of effective work relationships Briefly explain how each system supports the development of effective work relationships.

-

Power and Influence Personal Plan - How will you navigate the realms of power and influence? Why is this personal plan important for you? What do you want to achieve? do a table with SMART goals -...

-

A single-stage trickling-filter plant is proposed for treating a dilute wastewater with a BOD concentration of 170 mg/L. The plant is located in a warm climate, and the minimum wastewater temperature...

-

For the first assignment for this course, compose a written document that contains the following: A description and assessment of your past experiences with policy and program planning, either your...

-

What are the key motivators driving consumer purchasing decisions in our industry? How do consumers perceive our brand compared to competitors, and what factors influence brand loyalty?

-

What is the name of the screen that displays a logo and version number of an application allowing the program to load?

-

What are the two components of a company's income tax provision? What does each component represent about a company's income tax provision?

-

Using a CPU that runs an operating system that uses RMS, try to get the CPU utilization up to 100%. Vary the data arrival times to test the robustness of the system.

-

Nature Foods Grocery reported the following comparative income statements for the years ended June 30, 2019 and 2018: During 2019, Nature Foods Grocery discovered that ending 2018 merchandise...

-

Calm Day reported the following income statement for the year ended December 31, 2019: Requirements 1. Compute Calm Day's inventory turnover rate for the year. (Round to two decimal places.) 2....

-

Calm Day reported the following income statement for the year ended December 31, 2019: Requirements 1. Compute Calm Day's inventory turnover rate for the year. (Round to two decimal places.) 2....

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App