Retic Ltd. acquired 100% of the share capital of Dorado Ltd. for $102,000 on January 1, 2011,

Question:

Retic Ltd. acquired 100% of the share capital of Dorado Ltd. for $102,000 on January 1, 2011, when the equity of Dorado consisted of:

Share capital€”50,000 shares........ $50,000

Retained earnings ............ 30,000

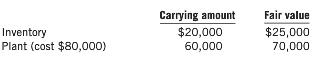

All of Dorado€™s identiï¬able assets and liabilities were recorded at amounts equal to fair value, except as follows:

The plant is expected to have a further useful life of ï¬ve years. All the inventory on hand at January 1, 2011, was sold by December 31, 2011. The income tax rate is 40%. At December 31, 2013, the following information was obtained from both entities.

-2.png)

Required

(a) Prepare the consolidation process adjustments for the preparation of consolidated financial statements for Retic and its subsidiary, Dorado, as at January 1, 2011.

(b) Prepare the consolidated ï¬nancial statements for Retic and its subsidiary, Dorado, as at December 31, 2013.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: