Return to the start of Section 6.3, where we calculated the equivalent annual cost, in cents per

Question:

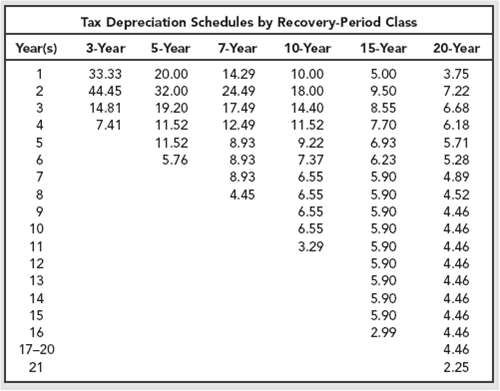

Return to the start of Section 6.3, where we calculated the equivalent annual cost, in cents per gallon, of producing reformulated gasoline in California. Capital investment was $400 million. Suppose this amount can be depreciated for tax purposes on the 10-year MACRS schedule from Table 6.4. The marginal tax rate, including California taxes, is 39 percent, and the cost of capital is 7 percent. The refinery improvements have an economic life of 25 years.

a. Calculate the after-tax equivalent annual cost. It?s easiest to use the PV of depreciation tax shields as an offset to the initial investment.

b. How much extra would retail gasoline customers have to pay to cover this equivalent annual cost? Note: Extra income from higher retail prices would betaxed.

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers