Rework Problem 9-18, Parts a, b, and c, using a spreadsheet model. For Part b, calculate the

Question:

Rework Problem 9-18, Parts a, b, and c, using a spreadsheet model. For Part b, calculate the price, dividend yield, and capital gains yield as called for in the problem. After completing Parts a through c, answer the following additional question using the spreadsheet model.

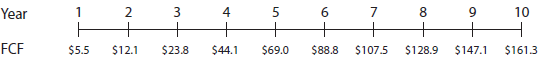

d. TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash flows were projected:

After the tenth year, TTC’s financial planners anticipate that its free cash flow will grow at a constant rate of 6%. Also, the firm concluded that the new product caused the WACC to fall to 9%. The market value of TTC’s debt is $1,200 million, it uses no preferred stock, and there are 20 million shares of common stock outstanding. Use the corporate valuation model approach to value the stock.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston