Richard Company is preparing its multiple-step income statement, owner?s equity statement, and classified balance sheet. Using the

Question:

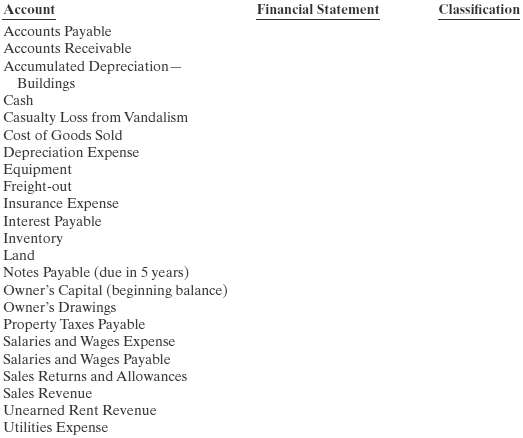

Richard Company is preparing its multiple-step income statement, owner?s equity statement, and classified balance sheet. Using the column heads Account, Financial Statement, and Classification, indicate in which financial statement and under what classification each of the following would be reported.

Transcribed Image Text:

Financial Statement Classification Account Accounts Payable Accounts Receivable Accumulated Depreciation- Buildings Cash Casualty Loss from Vandalism Cost of Goods Sold Depreciation Expense Equipment Freight-out Insurance Expense Interest Payable Inventory Land Notes Payable (due in 5 years) Owner's Capital (beginning balance) Owner's Drawings Property Taxes Payable Salaries and Wages Expense Salaries and Wages Payable Sales Returns and Allowances Sales Revenue Unearned Rent Revenue Utilities Expense

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (18 reviews)

Account Accounts Payable Accounts Receivable Accumulated Depreciation Buildings Financial Statement ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Accounting questions

-

Indicate whether each of the following would be reported on the balance sheet (B/S), income statement (I/S), or statement of stockholders' equity (SSE). 1. Insurance costs paid this year, to expire...

-

Indicate whether each of the following would be added to or deducted from net income in determining net cash flow from operating activities by the indirect method: a. Decrease in accounts payable b....

-

Indicate whether each of the following would be treated as a debit or a credit in a journal entry. a. Increase in equipment. b. Increase in unearned revenue. c. Decrease in accounts receivable. d....

-

Can you draw the upper shear zone margin on Figure 16.9? Is it easily definable?

-

How does horizontal FDI compare to vertical FDI?

-

Storing all blocks of a large file on consecutive disk blocks would minimize seeks during sequential file reads. Why is it impractical to do so? What do operating systems do instead, to minimize the...

-

Drilling down beneath a lake in Alaska yields chemical evidence of past changes in climate. Biological silicon, left by the skeletons of single-celled creatures called diatoms, is a measure of the...

-

The first case at the end of this chapter and each of the remaining chapters is a series of integrative cases involving Starbucks. The series of cases applies the concepts and analytical tools...

-

The SP Corporation makes 38,000 motors to be used in the production of its sewing machines. The average cost per motor at this level of activ Direct materials $ 9.70 Direct labor $ 8.70 Variable...

-

Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the calendar year and accrual basis for both book and tax purposes. It is engaged in the sale of...

-

The trial balance of Ogilvys Boutique at December 31 shows Inventory $21,000, Sales Revenue $156,000, Sales Returns and Allowances $4,000, Sales Discounts $3,000, Cost of Goods Sold $92,400, Interest...

-

Mr. Lucas has prepared the following list of statements about service companies and merchandisers. 1. Measuring net income for a merchandiser is conceptually the same as for a service company. 2. For...

-

AWFOSS4 Swiss Cheese Model. 1. What is the main purpose of implementing the Swiss Cheese Model in a workplace? 2. Categorize engineering controls, administrative controls, behavioral controls, and...

-

Context This task requires analysing a network scenario, design the network architecture and recommend IT solutions including ethical, security and sustainability considerations.The purpose of this...

-

What was the Prime Cost Percent for Mandy's BBQ Pit for August? Select one: a. 46.5% b. 73.9% c. 63.4% d. 85%

-

Finding Critical Values and Confidence Intervals. In Exercises 5-8, use the given information to find the number of degrees of freedom, the critical values x? and x*, and the confidence interval...

-

An investor sold 100 shares of ABC stock short at $25 and buys one ABC Jan 30 call @ $5. What is this investor's maximum gain, maximum loss, and breakeven points from this strategy?

-

Jake, Sachs and Brianne own a tour company called Adventure Sports. The partners share profits and losses in a 1:3:4 ratio. After Lengthy Dissagreements among the partners and several unprofitable...

-

Understand the concept of quality of earnings. AppendixLO1

-

An investor sells a European call on a share for $4. The stock price is $47 and the strike price is $50. Under what circumstances does the investor make a profit? Under what circumstances will the...

-

Compute the following under the given (t) defined on t [0,] and measured in years. a. The present value at t = 0 of $550 due at time t = 2 under (t) = 0.02t 3 per annum. b. The present value at t =...

-

Data for investments in stock classified as trading securities are presented in E16-10. Assume instead that the investments are classified as available-for-sale securities. They have the same cost...

-

McGee Company has the following data at December 31, 2010. The available-for-sale securities are held as a long-term investment.Instructions(a) Prepare the adjusting entries to report each class of...

-

Davison Carecenters Inc. provides financing and capital to the health-care industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds...

-

! Required information [ The following information applies to the questions displayed below. ] Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividends Year 4 total cash...

-

WISE-HOLLAND CORPORATION On June 15, 2013, Marianne Wise and Dory Holland came to your office for an initial meeting. The primary purpose of the meeting was to discuss Wise-Holland Corporation's tax...

-

! Required information [ The following information applies to the questions displayed below. ] Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividends Year 4 total cash...

Study smarter with the SolutionInn App