Riley Instruments, a rapidly expanding electronic parts distributor, is in the process of formulating plans for next

Question:

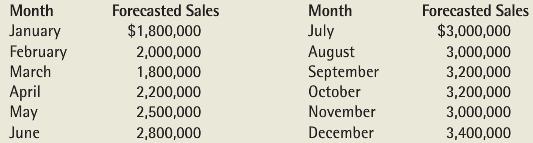

Riley Instruments, a rapidly expanding electronic parts distributor, is in the process of formulating plans for next year. Bill Stockton, the firm’s director of marketing, has completed his sales forecast and is confident that sales estimates will be met or exceeded. The following sales figures show the growth expected and will provide the planning basis for other corporate departments.

Samantha Carlson, assistant controller, has been given the responsibility for formulating the cash flow projection, a critical element during a period of rapid expansion. The following information will be used in preparing the cash analysis.

1. Riley has experienced an excellent record in accounts receivable collection and expects this trend to continue. Sixty percent of billings are collected in the month after the sale and 40% in the second month after the sale. Un-collectibles are nominal and can be ignored in the analysis.

2. The purchase of electronic parts is Riley’s largest expenditure: the cost of these items is equal to 50% of sales. Sixty percent of the parts are received by Riley one month prior to sale and 40% are received during the month of sale.

3. Historically, 80% of accounts payable have been cleared by Riley one month after receipt of purchased parts and the remaining 20% have been cleared two months after receipt.

4. Hourly wages, including fringe benefits, are a function of sales volume and are equal to 20% of the current month’s sales. These wages are paid in the month incurred.

5. General and administrative expenses are projected to be $2,640,000 for the next period. These include $480,000 in salaries, $660,000 in product promotions, $240,000 in property taxes, $360,000 for insurance, $300,000 in utilities, and $600,000 in depreciation. All expenses except property taxes are incurred uniformly throughout the year, and property taxes are paid in four equal installments in the last month of each calendar quarter.

6. Riley makes income tax payments in the first month of each quarter based on the income for the prior quarter. Riley is subject to an effective income tax rate of 40%. Riley’s pretax income for the first quarter of the next year is projected to be $612,000.

7. Riley has a corporate policy of maintaining an end-of-month cash balance of $100,000.

Cash is invested or borrowed monthly, as necessary to maintain this balance.

REQUIRED

A. Prepare a spreadsheet with the cash receipts and disbursements budget for Riley Instruments by month for the second quarter. Be sure that all receipts, disbursements, and borrowing/investing are presented on a monthly basis. Ignore the interest expense and/or income associated with borrowing/investing.

B. Although this industry has experienced rapid growth over the last few years, competition from outside the country has also increased markedly and is beginning to affect prices. In fact, an offshore electronics manufacturer recently contacted Riley’s largest customer and has offered the same electronic product at a lower price. The customer would prefer to stay with Riley, but only if Riley will cut prices by 20%. Assume that half of all sales are to this customer. Perform sensitivity analysis using the cash budget as a flexible budget to determine whether Riley would be better off to reduce prices or to drop the customer.

C. Consider the decision that needs to be made from the following viewpoints: (1) vendors who supply Riley with the parts, (2) direct labor employees, and (3) managers. Would any of these stakeholders be willing to make concessions to help Riley meet the 20% price reduction? Explain.

D. Write a memo detailing your findings and making a recommendation to the CEO of Riley about the decision to drop the customer or to lower prices.

StakeholdersA person, group or organization that has interest or concern in an organization. Stakeholders can affect or be affected by the organization's actions, objectives and policies. Some examples of key stakeholders are creditors, directors, employees,... Accounts Payable

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Cost Management Measuring Monitoring And Motivating Performance

ISBN: 392

2nd Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott