Several transactions entered into by Travis Retail during 2012 follow: 1. Received $50,000 for wine previously sold

Question:

Several transactions entered into by Travis Retail during 2012 follow:

1. Received $50,000 for wine previously sold on account.

2. Paid $55,000 in wages.

3. Sold a building for $100,000. The building had cost $170,000, and the related accumulated depreciation at the time of sale was $55,000.

4. Declared and paid a cash dividends of $70,000.

5. Repurchased 10,000 shares of outstanding common stock at $50 per share.

6. Purchased a two-year, $100,000 fire and storm insurance policy on June 30.

7. Purchase some equipment in exchange for 1,000 shares of common stock. The stock was currently selling for $75 per share.

8. Purchased $500,000 in equity securities considered to be long-term.

9. Issued $200,000 face value bonds. The bonds were sold at 101.

10. Owned $30,000 in rent as of December 31.

Required

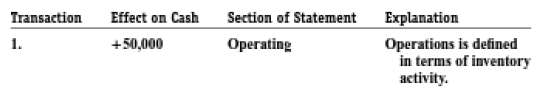

Record each transaction on a chart like the following. Classify the sections of the statement of cash flows as a chart flow from operating, investing, or financing activities. Transaction (1) is done as an example.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer: