Show that the BlackScholesMerton formula for a call option gives a price that tends to max (So-

Question:

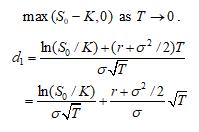

Show that the Black–Scholes–Merton formula for a call option gives a price that tends to

max (So- K,0)

Step by Step Answer:

As the second term on the right hand side tends to zero The first ...View the full answer

Related Video

A call option is a type of financial contract that gives the holder the right, but not the obligation, to buy an underlying asset (such as a stock, commodity, or currency) at a specified price (called the strike price) within a specified period of time. When an investor purchases a call option, they are essentially betting that the price of the underlying asset will rise above the strike price before the option\'s expiration date. If the price of the asset does rise above the strike price, the investor can exercise the option by buying the asset at the strike price and then selling it at the higher market price, thereby earning a profit. Call options are often used as a speculative investment strategy, as they allow investors to potentially profit from the upward movement of an asset without having to actually own the asset itself. They are also commonly used as a hedging tool to protect against potential losses in a portfolio.

Students also viewed these Corporate Finance questions

-

The appendix derives the key result: E[max(VK,0)]=E(V)N(d 1 ) KN(d 2 ). Show that E[max(KV,0)]=KN(d 1 ) E(V)N(d 2 ) and use this to derive the Black-Scholes-Merton formula for the price of a European...

-

In its 10-Q dated November 2, 2007, Dell, Inc., had outstanding employee stock options representing over 272 million shares of its stock. Dell accountants estimated the value of these options using...

-

Consider the right-hand side of the Black-Scholes-Merton formula as consisting of the sum of two terms? Explain what each of those terms represents.

-

A bartender employed in a licensed establishment over-serves a patron. As a result of the over-service, the patron physically assaults another patron by striking him with a beer bottle. Identify and...

-

Define research. How is it valuable to a forensic accountant?

-

Nodebt Inc. is a firm with all-equity financing. Its equity beta is .80. The Treasury bill rate is 4%, and the market risk premium is expected to be 10%. a. What is Nodebt's asset beta? b. What is...

-

1.79

-

Easy Move Company made the following expenditures on one of its delivery trucks: Feb. 16. Replaced transmission at a cost of $3,150 July 15. Paid $1,100 for installation of a hydraulic lift Oct. 3....

-

In 1952 Blayney Scott and his wife Almeda started a small company in Victoria, British Columbia, Canada that pioneered the use of plastics in the manufacturing of marine products. Scotty...

-

The following data represent the number of passengers per flight for a random sample of 50 flights from Jacksonville, Florida, to Baltimore, Maryland, on one particular airline: Estimate the average...

-

A call option on a non-dividend-paying stock has a market price of $2.50. The stock price is $15, the exercise price is $13, the time to maturity is three months, and the risk-free interest rate is...

-

Explain carefully why Blacks approach to evaluating an American call option on a dividend-paying stock may give an approximate answer even when only one dividend is anticipated. Does the answer given...

-

What determines whether budget deficits will result in inflation in the long run?

-

The following graph shows a market supply curve in orange and a market demand curve in blue. Suppose there is an increase in demand and an increase in supply. Adjust the following graph to reflect...

-

AICPA and PCAOB auditing standards address the confirmation of accounts receivables. Under the currently effective standards, what are the circumstances under which confirmation of accounts...

-

Maphitha Limited produces a single type of a product. The company uses an actual costing system. The following information has been taken from the company's production and sales records for the month...

-

Master Budget was made for annual sale of 100,000 units @10 per unit. Actual sales figures were 80,000 units with a sales revenues of 840,00. The standard cost sheet indicated a variable...

-

Sales of a product was estimated at 80,000 pieces annually with a rate of 6 pu. Its variable mfg. costs are 2.50 pu with S&D and general expenses related to product is 59,000 on annual basis. Its...

-

In the previous question, Elan Corp plc announced that it plans to increase its non-current assets by 100 million. If the company wishes to maintain its ratio of total liabilities to equity, how much...

-

Suppose the S&P 500 futures price is 1000, = 30%, r = 5%, = 5%, T = 1, and n = 3. a. What are the prices of European calls and puts for K = $1000? Why do you find the prices to be equal? b. What...

-

What would you do if you were the employee? A new employee showed up for work at a prestigious southwestern US healthcare system. He had just finished a master of health administration degree and was...

-

Calculate the price of a three-month European call option on the spot price of silver. The three-month futures price is $12, the strike price is $13, the risk-free rate is 4%, and the volatility of...

-

Use a three-step tree to value an American put futures option when the futures price is 50, the life of the option is 9 months, the strike price is 50, the risk-free rate is 3%, and the volatility is...

-

Calculate the price of a six-month European put option on the spot value of the S&P 500. The six-month forward price of the index is 1,400, the strike price is 1,450, the risk-free rate is 5%, and...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App