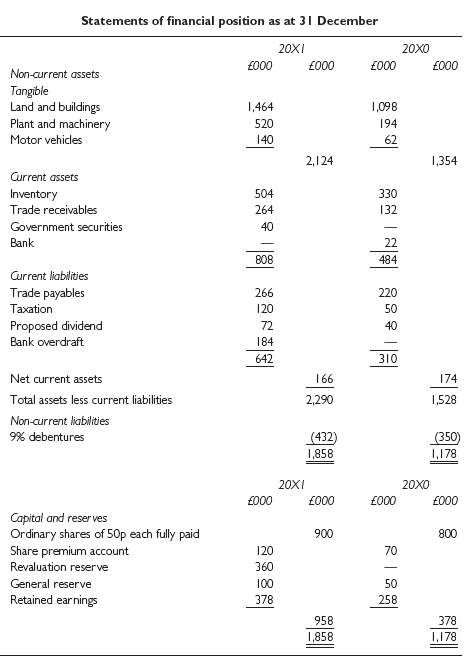

Shown below are the summarized final accounts of Martel plc for the last two financial years: Summarised

Question:

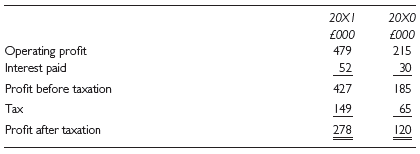

Summarised statement of comprehensive income for the year ending 31 December

Additional information:

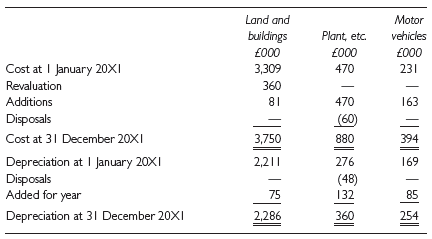

1 The movement in non-current assets during the year ended 31 December 20X1 was as follows:

The plant and machinery disposed of during the year was sold for £20,000.

2 During 20X1, a rights issue was made of one new ordinary share for every eight held at a price of £1.50.

3 A dividend of £36,000 (20X0 £30,000) was paid in 20X1. A dividend of £72,000 (20X0 £40,000) was proposed for 20X1. A transfer of £50,000 was made to the general reserve.

Required:

(a) Prepare a statement of cash flows for the year ended 31 December 20X1, in accordance with IAS 7.

(b) Prepare a report on the liquidity position of Martel plc for a shareholder who is concerned about the lack of liquid resources in thecompany.

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott