Simpson Ltd. is a private Ontario corporation controlled by Ted Simpson. The company owns a series of

Question:

Simpson Ltd. is a private Ontario corporation controlled by Ted Simpson. The company owns a series of chocolate chip cookie stores throughout Ontario, and also has a wholly owned Quebec subsidiary that operates stores in Montreal and Quebec City. Because of its lack of stores in Western Canada and its managers’ lack of knowledge about that part of the country, Simpson Ltd. has just acquired 70% of the outstanding class A voting shares of Ong Inc. for $ 6,000,000 cash. Ong Inc. is another cookie store chain that is headquartered in Vancouver and has stores throughout Vancouver and Victoria, as well as in Edmonton, Saskatoon, and Winnipeg.

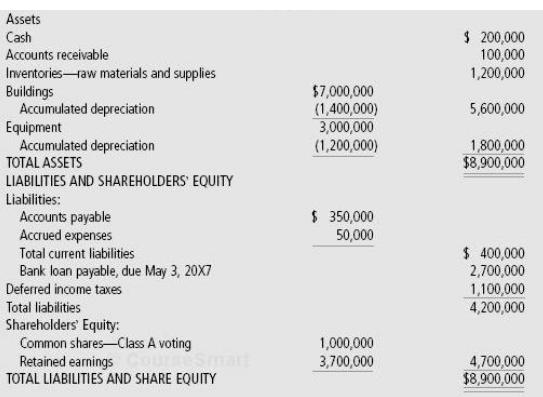

Ted expects that the acquisition will greatly help the Simpson Ltd. “bottom line,” which in turn will help Simpson Ltd. to obtain expanded debt financing because of the greater net income and cash flow. The management of Ong Inc. will not change as a result of the purchase; the former sole owner, John Ong, retains the remaining 30% of the Ong Inc. shares and has agreed to continue as CEO of Ong Inc. for at least five years after the change in control. The president and chief operating officer, Travis Hubner, will also stay on, so there is no reason that the acquired company should not continue to be highly profitable. The condensed SFP of Ong Inc. at the date of acquisition is shown in Exhibit B.

The acquisition was financed mainly by debt; $ 4,500,000 was borrowed by Simpson Ltd. from the Western Bank of British Columbia, secured by the assets of both Simpson Ltd. and Ong Inc. The bank has requested audited financial statements of both companies on an annual basis, supplemented by unaudited quarterly statements.

Ong Inc. owns the buildings in which some of its stores are located, but most are leased. None of the land is owned. The buildings are being depreciated over 30 years. John has obtained two separate appraisals of the owned buildings; one appraisal firm has placed the aggregate current value at $ 9,500,000, while the second firm arrived at a value of $ 8,400,000. Ong Inc. owns all of the equipment in its stores; the equipment is being depreciated over 10 years, and is, on average, 40% depreciated. It would cost $ 3,300,000 to replace the existing equipment with new equipment of similar capacity. Inventories are generally worth their carrying values, except that the replacement cost of the stock of Ong Inc. Condensed Statement of Financial Position

Condensed Statement of Financial Position

May 8, 20X5

Imported Belgian chocolate in the Vancouver warehouse is $ 20,000 less than carrying value because of the strengthening Canadian dollar. On the other hand, the accounts payable shown in Exhibit B include an unrealized gain of $ 10,000 because much of the liability is denominated in Belgian francs.

Required

Determine, on a line-by-line basis, the impact on Simpson Ltd.’ s consolidated assets and liabilities as a result of the acquisition, in accordance with Ted Simpson’s objectives in acquiring Ong. Where alternative values could be used, explain the reasons for your selection.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay