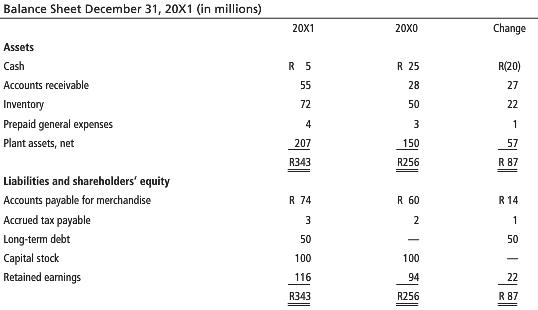

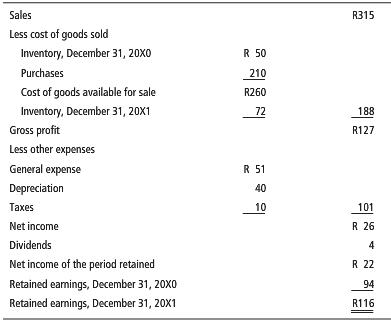

South African Imports Company has assembled the (a) balance sheet and (b) income statement and change in

Question:

South African Imports Company has assembled the (a) balance sheet and (b) income statement and change in retained earnings for 20X1 shown in Exhibit 16-23. On December 30, 20X1, South African Imports paid R103 million in cash to acquire a new warehouse to expand operations. (R stands for rand, the South African currency.) This was partly financed by an issue of long-term debt for R 50 million cash. The company sold plant assets for their book value of R 6 million during 20X1. Because net income was R 26 million, the highest in the company’s history, Julie Botha, the CEO, was distressed by the company’s extremely low cash balance.

1. Prepare a statement of cash flows using the direct method for reporting cash flows from operating activities. You may wish to use Exhibit 16-12 on page 678 as a guide.

2. Prepare a schedule that reconciles net income to net cash provided by operating activities.

3. What is revealed by the statement of cash flows? Does it help you reduce Ms. Botha’s distress? Why? Briefly explain to Ms. Botha why cash has decreased even though net income was R 26 million.

Income Statement and Change in Retained Earnings for the Year Ended December 31, 20X1 (in millions)

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta