Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm's financial

Question:

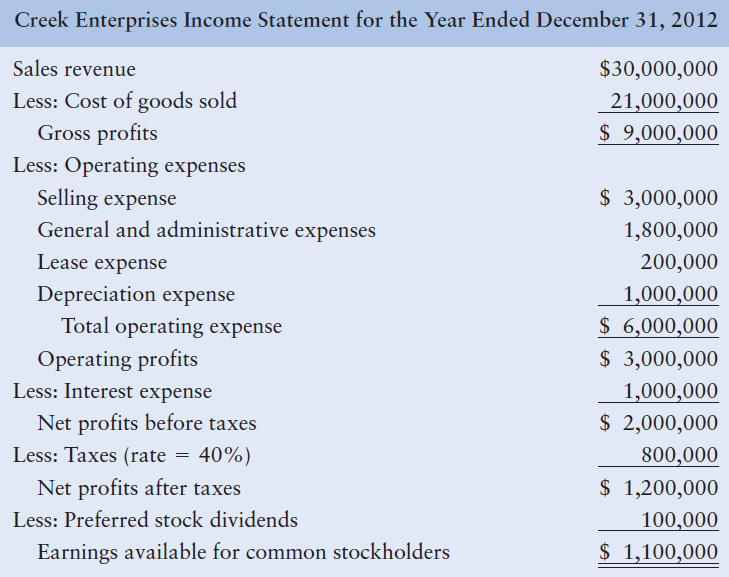

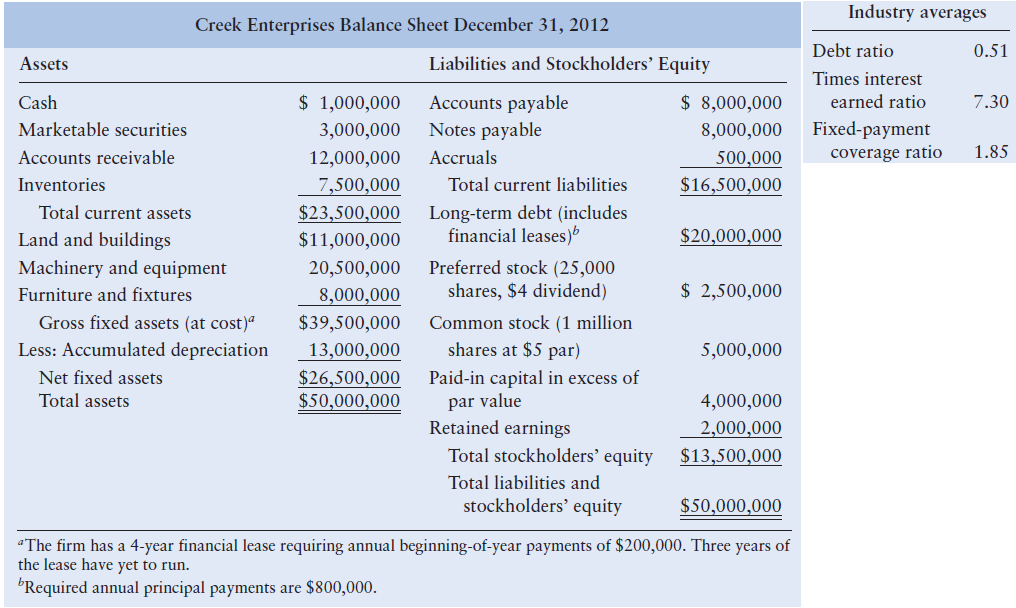

Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry averages and Creek's recent financial statements (following), evaluate and recommend appropriate action on the loan request.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Creek Enterprises Income Statement for the Year Ended December 31, 2012 Sales revenue Less: Cost of goods sold $30,000,000 Gross profits Less: Operating expenses Selling expense General and administrative Lease expense Depreciation expense 3,000,000 1,800,000 200,000 expenses Total operating expense Less: Interest expense Less: Taxes (rate-4096) Less: Preferred stock dividends Operating profits Net profits before taxes Net profits after taxes Earnings available for common stockholders 3,000,000 2,000,000 $ 1,200,000 Industry averages Creek Enterprises Balance Sheet December 31, 2012 0.51 S 8,000,000 rned ratio 7.30 o 1.85 Debt ratio Liabilities and Stockholders' Equity Assets Cash Marketable securities Accounts receivable Inventories mes interest S 1,000,000 Accounts payable 3,000,000 Notes payable 12,000,000 Accruals 7,500,000 Total current liabilities $16,500,000 8,000,000 Fixed-payment 500,000 coverage rati $23.500,000 Long-term debt (includes $11,000,000 icial leases) Total current assets Land and buildings Machinery and equipment Furniture and fixtures Preferred stock (25,000 shares, $4 dividend) 20,500,000 S 2,500,000 Gross fixed assets (at cost) $39,500,000 Common stock (1 million Less: Accumulated depreciation 13,000,000 sres at $5 par) 5,000,000 4,000,000 quity S13.500.000 Net fixed assets Total assets $26,500,000 550.000.00 Paid-in capital in excess of 0 par value Retained earnings Total stockholders' e Total liabilities and stockholders' equity The firm has a 4-year financial lease requiring annual beginning-of-year payments of $200,000. Three years of the lease have yet to run. Required annual principal payments are $800,000.

Step by Step Answer:

Because Creek Enterprises has a much higher degree of indebtedness and much lower ability to servic...View the full answer

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Finance questions

-

Springfield Bank is evaluating Creek Enterprises, which has requested a $3,540,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along...

-

What do the terms financial leverage and financial risk mean?

-

The firm was initially capitalized with 500 000 as an S Corporation The firm purchased equipment for 450 000 with cash of 125 000 and a note payable of 325 000 It also acquired furniture for 120 000...

-

The following information provides details of costs, volume and cost drivers for a particular period in respect of ABC plc, a hypothetical company: ( Details Direct Material $25 Cost Direct Labor 4/3...

-

The following information is available for The Coca-Cola Company (in U.S. $ millions): In the notes to its financial statements, Coca-Cola disclosed that it uses the FIFO and average cost methods to...

-

Matt E. Matic was applying for a job. To determine whether he could handle the job, the personnel manager sent him out to poll 100 people about their favorite types of TV shows. His data were as...

-

Divide a sheet of notebook paper into five columns. In the first column, under the heading Strengths, list all the strengths that any of the types of group structures might have (e.g., generates many...

-

The Action Paper Company employs a human resources manager who is given responsibility for employee benefits. There is a question about the mean annual dental expense per employee. The manager...

-

Please answer question #8, SHOWING ALL WORK ACCORDINGLY. Thank you! Novak Corp. was organized on January 1, 2021. During its first year the corporation issued 2,100 shares of $50 par value preferred...

-

The seasonal yield of olives in a Piraeus, Greece vineyard is greatly influenced by a process of branch pruning. If olive trees are pruned every two weeks, output is increased. The pruning process,...

-

The new owners of Bluegrass Natural Foods, Inc., have hired you to help them diagnose and cure problems that the company has had in maintaining adequate liquidity. As a first step, you perform a...

-

A common-size income statement for Creek Enterprises 2011 operations follows. Using the firms 2012 income statement presented in Problem 318, develop the 2012 common-size income statement and compare...

-

Sale prices of apartments. A Minneapolis, Minnesota, real estate appraiser used regression analysis to explore the relationship between the sale prices of apartment buildings and various...

-

Carla Vista Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan Plan assets $489,900 Projected benefit obligation 616,700...

-

Question 2 of 8 Shirts were purchased for $12.50 each and were marked up by $18.75. During Christmas, they were discounted by $6.85 per shirt. a. What was the rate of markdown? % Round to two decimal...

-

The cost versus quality decision is one that only few companies get right. What is the cost of quality? It is very high for some companies such as Ford and Bridgestone/Firestone, whose reputations...

-

Find the absolute maximum and absolute minimum values of the function f(x) (x-2)(x-5)+7 = on each of the indicated intervals. Enter 'NONE' for any absolute extrema that does not exist. (A) Interval =...

-

4. Roll one 10-sided die 12 times. The probability of getting exactly 4 eights in those 12 rolls is given by (a) 10 9 4 10 10 (b) HA 9 -HAA (c) 1 (d) 9 (c) 10 9 () 10

-

British Petroleum In May 1901, William Knox DArcy convinced the Shah of Persia (present-day Iran) to allow him to hunt for oil. The oil discovered in Persia in 1908 was the first commercially...

-

A report from the college dean indicates that for the previous semester, the grade distribution for the Department of Psychology included 135 As, 158 Bs, 140 Cs, 94 Ds, and 53 Fs. Determine what kind...

-

At the beginning of this section, three hints for success were listed. Discuss each of these from your perspective. Are there any other hints that you might add to this list?

-

Jenny Jenks has researched the financial pros and cons of entering into an elite MBA program at her state university. The tuition and needed books for a masters program will have an upfront cost of...

-

Neil Corporation has three projects under consideration. The cash flows for each project are shown in the following table. The firm has a 16% cost of capital. a. Calculate each project's payback...

-

Neil Corporation has three projects under consideration. The cash flows for each project are shown in the following table. The firm has a 16% cost of capital. a. Calculate each project's payback...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

-

Be prepared to explain the texts comprehensive To illustrate the issues related to interest capitalization, assume that on November 1, 2016, Shalla Company contracted Pfeifer Construction Co. to...

-

On April 1, 2020. Indigo Company received a condemnation award of $473,000 cash as compensation for the forced sale of the company's land and building, which stood in the path of a new state highway....

Study smarter with the SolutionInn App