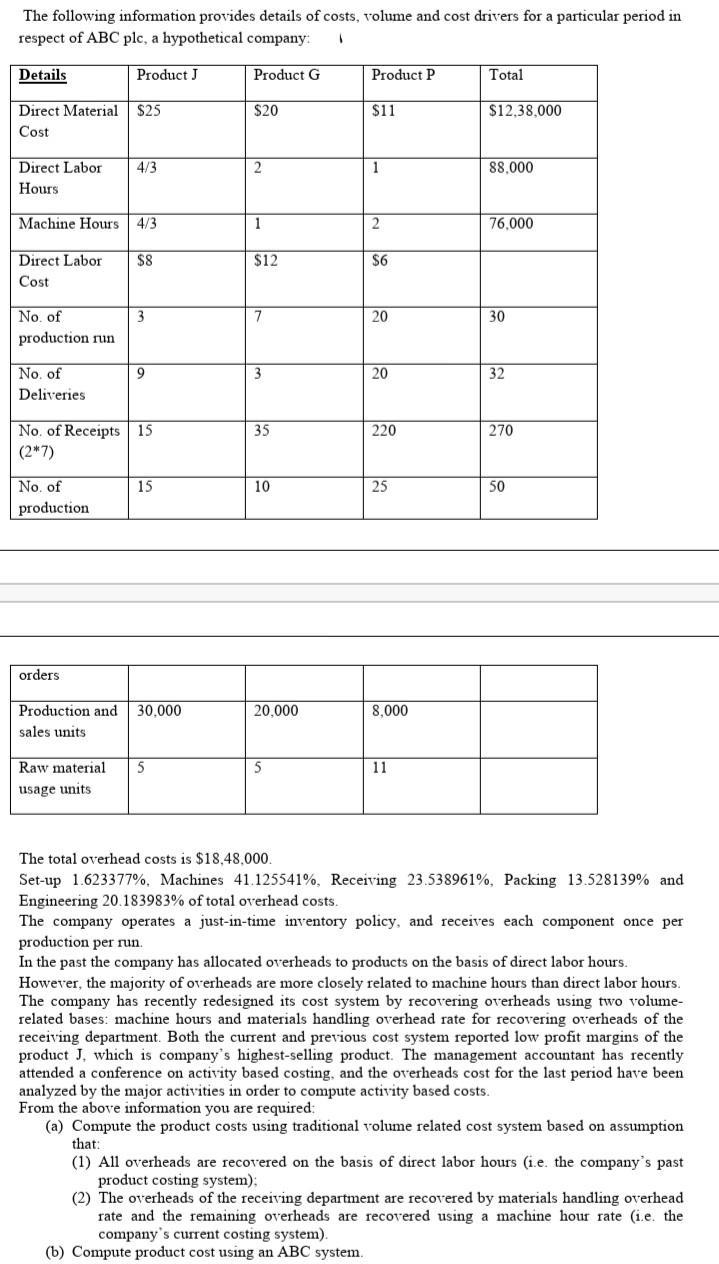

The following information provides details of costs, volume and cost drivers for a particular period in respect of ABC plc, a hypothetical company: (

The following information provides details of costs, volume and cost drivers for a particular period in respect of ABC plc, a hypothetical company: ( Details Direct Material $25 Cost Direct Labor 4/3 Hours Machine Hours 4/3. Direct Labor $8 Cost No. of production run Product J No. of Deliveries No. of production orders No. of Receipts 15 (2*7) 3 Raw material usage units 9 15 Production and 30,000 sales units 5 Product G $20 2 1 $12 7 3 35 10 20,000 5 Product P $11 1 2 $6 20 20 220 25 8,000 11 Total $12,38,000 88,000 76,000 30 32 270 50 The total overhead costs is $18.48,000. Set-up 1.623377%. Machines 41.125541%, Receiving 23.538961%, Packing 13.528139% and Engineering 20.183983 % of total overhead costs. The company operates a just-in-time inventory policy, and receives each component once per production per run. In the past the company has allocated overheads to products on the basis of direct labor hours. However, the majority of overheads are more closely related to machine hours than direct labor hours. The company has recently redesigned its cost system by recovering overheads using two volume- related bases: machine hours and materials handling overhead rate for recovering overheads of the receiving department. Both the current and previous cost system reported low profit margins of the product J, which is company's highest-selling product. The management accountant has recently attended a conference on activity based costing, and the overheads cost for the last period have been analyzed by the major activities in order to compute activity based costs. From the above information you are required: (a) Compute the product costs using traditional volume related cost system based on assumption that: (1) All overheads are recovered on the basis of direct labor hours (i.e. the company's past product costing system); (2) The overheads of the receiving department are recovered by materials handling overhead rate and the remaining overheads are recovered using a machine hour rate (i.e. the company's current costing system). (b) Compute product cost using an ABC system.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started