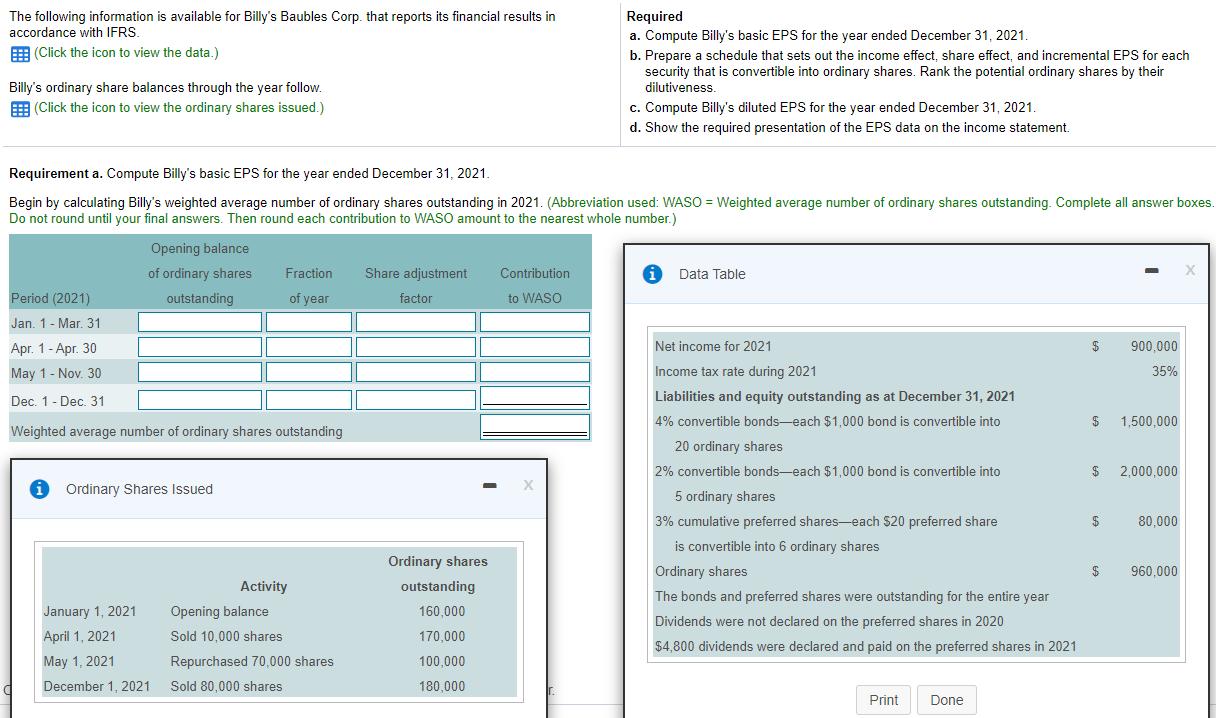

The following information is available for Billy's Baubles Corp. that reports its financial results in accordance with IFRS. (Click the icon to view the

The following information is available for Billy's Baubles Corp. that reports its financial results in accordance with IFRS. (Click the icon to view the data.) Billy's ordinary share balances through the year follow. (Click the icon to view the ordinary shares issued.) Opening balance of ordinary shares outstanding Requirement a. Compute Billy's basic EPS for the year ended December 31, 2021. Begin by calculating Billy's weighted average number of ordinary shares outstanding in 2021. (Abbreviation used: WASO = Weighted average number of ordinary shares outstanding. Complete all answer boxes. Do not round until your final answers. Then round each contribution to WASO amount to the nearest whole number.) Period (2021) Jan. 1- Mar. 31 Apr. 1-Apr. 30 May 1 - Nov. 30 Dec. 1 - Dec. 31 Weighted average number of ordinary shares outstanding Ordinary Shares Issued Fraction of year January 1, 2021 April 1, 2021 May 1, 2021 December 1, 2021 Activity Opening balance Sold 10,000 shares Repurchased 70,000 shares Sold 80,000 shares Share adjustment factor Ordinary shares outstanding 160,000 170,000 100,000 180,000 Contribution to WASO Required a. Compute Billy's basic EPS for the year ended December 31, 2021. b. Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each security that is convertible into ordinary shares. Rank the potential ordinary shares by their dilutiveness. X c. Compute Billy's diluted EPS for the year ended December 31, 2021. d. Show the required presentation of the EPS data on the income statement. Data Table Net income for 2021 Income tax rate during 2021 Liabilities and equity outstanding as at December 31, 2021 4% convertible bonds each $1,000 bond is convertible into 20 ordinary shares 2% convertible bonds-each $1,000 bond is convertible into 5 ordinary shares 3% cumulative preferred shares-each $20 preferred share is convertible into 6 ordinary shares Ordinary shares The bonds and preferred shares were outstanding for the entire year Dividends were not declared on the preferred shares in 2020 $4,800 dividends were declared and paid on the preferred shares in 2021 Print Done $ $ $ WOR $ 900,000 35% $ 2,000,000 1,500,000 80,000 960,000 X The following information is available for Billy's Baubles Corp. that reports its financial results in accordance with IFRS. (Click the icon to view the data.) Billy's ordinary share balances through the year follow. (Click the icon to view the ordinary shares issued.) Opening balance of ordinary shares outstanding Requirement a. Compute Billy's basic EPS for the year ended December 31, 2021. Begin by calculating Billy's weighted average number of ordinary shares outstanding in 2021. (Abbreviation used: WASO = Weighted average number of ordinary shares outstanding. Complete all answer boxes. Do not round until your final answers. Then round each contribution to WASO amount to the nearest whole number.) Period (2021) Jan. 1- Mar. 31 Apr. 1-Apr. 30 May 1 - Nov. 30 Dec. 1 - Dec. 31 Weighted average number of ordinary shares outstanding Ordinary Shares Issued Fraction of year January 1, 2021 April 1, 2021 May 1, 2021 December 1, 2021 Activity Opening balance Sold 10,000 shares Repurchased 70,000 shares Sold 80,000 shares Share adjustment factor Ordinary shares outstanding 160,000 170,000 100,000 180,000 Contribution to WASO Required a. Compute Billy's basic EPS for the year ended December 31, 2021. b. Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each security that is convertible into ordinary shares. Rank the potential ordinary shares by their dilutiveness. X c. Compute Billy's diluted EPS for the year ended December 31, 2021. d. Show the required presentation of the EPS data on the income statement. Data Table Net income for 2021 Income tax rate during 2021 Liabilities and equity outstanding as at December 31, 2021 4% convertible bonds each $1,000 bond is convertible into 20 ordinary shares 2% convertible bonds-each $1,000 bond is convertible into 5 ordinary shares 3% cumulative preferred shares-each $20 preferred share is convertible into 6 ordinary shares Ordinary shares The bonds and preferred shares were outstanding for the entire year Dividends were not declared on the preferred shares in 2020 $4,800 dividends were declared and paid on the preferred shares in 2021 Print Done $ $ $ WOR $ 900,000 35% $ 2,000,000 1,500,000 80,000 960,000 X

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started