Stock A and Stock B have the following historical returns: a. Calculate the average rate of return

Question:

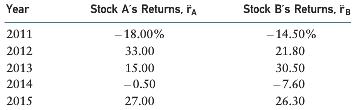

Stock A and Stock B have the following historical returns:

a. Calculate the average rate of return for each stock during the period 2011–2015.

b. Assume that someone held a portfolio consisting of 50 percent Stock A and 50 percent Stock B. What would have been the realized rate of return on the portfolio in each year from 2011 through 2015? What would have been the average return on the portfolio during this period?

c. Calculate the standard deviation of returns for each stock and for the port- folio. Use Equation 11-4.

d. Calculate the coefficient of variation for each stock and for the portfolio.

e. If you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? Why?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: