On December 31, 2003, CL Limited, a Canadian company, acquired 100% ownership of British Company, a company

Question:

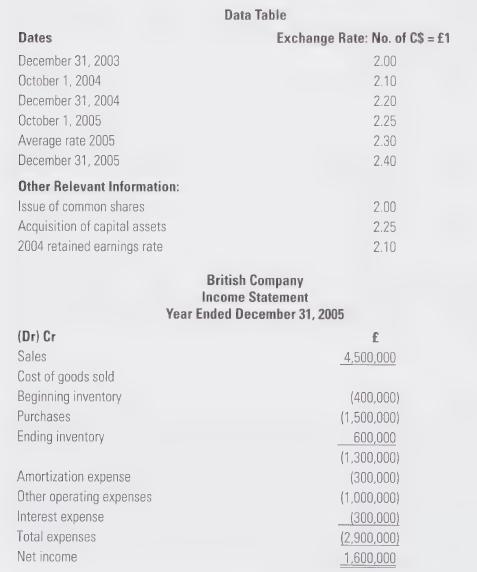

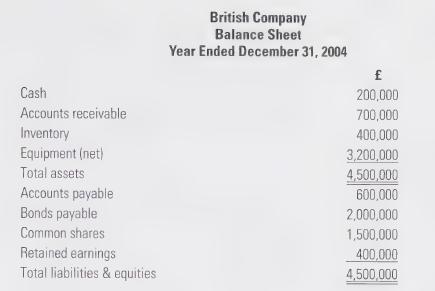

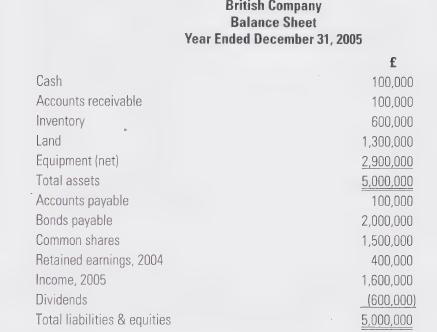

On December 31, 2003, CL Limited, a Canadian company, acquired 100% ownership of British Company, a company based in London, England. Information for the translation of the foreign subsidiary is presented below. Sales, purchases, operating expenses, and interest expense all occurred evenly throughout the year. The 2005 beginning inventory was acquired when the exchange rate was £1.00 = $2.15. The 2005 ending inventory was acquired on October 1, 2005, when the exchange rate was £1.00 = $2.25. The land was acquired on December 31, 2005. Dividends are declared and paid on December 31. The bonds mature on December 31, 2008.

Required:

Using the information provided, calculate the following ainounts:

a. Using the current-rate method, determine British Company's:

1. Cost of goods sold

2. Amortization expense

3. Equipment (net)—December 31, 2004

4. Equipment (net)—December 31, 2005

5. Common shares

6. Dividends—2005 .

b. Using the temporal method, determine British Company’s:

1. Cost of goods sold

2. Amortization expense

3. Equipment (net)—December 31, 2005

4. Bonds payable—December 31, 2005

5. Gain on current monetary items

Step by Step Answer: