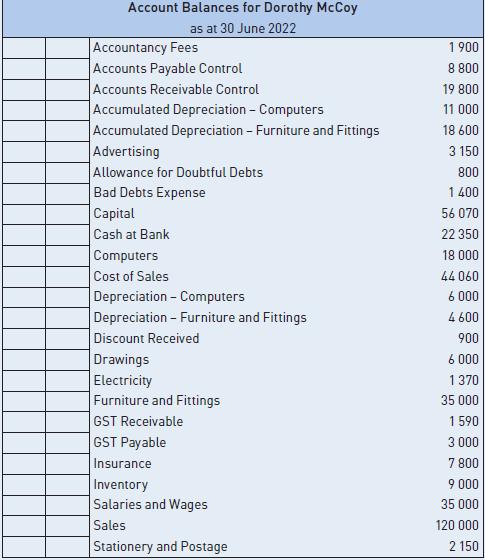

The account balances in figure 12.38 are from the ledger of Dorothy McCoy at 30 June 2022.

Question:

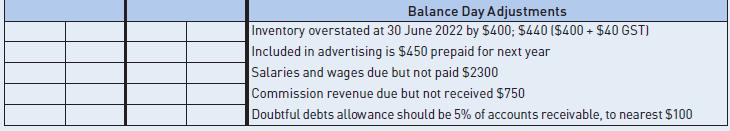

The account balances in figure 12.38 are from the ledger of Dorothy McCoy at 30 June 2022. The account, statement and group abbreviations should be entered. After incorporating the balance day adjustments, prepare an income statement and a balance sheet.

Transcribed Image Text:

Account Balances for Dorothy McCoy as at 30 June 2022 Accountancy Fees Accounts Payable Control Accounts Receivable Control Accumulated Depreciation - Computers Accumulated Depreciation - Furniture and Fittings Advertising Allowance for Doubtful Debts Bad Debts Expense Capital Cash at Bank Computers Cost of Sales Depreciation - Computers Depreciation - Furniture and Fittings Discount Received Drawings Electricity Furniture and Fittings GST Receivable GST Payable Insurance Inventory Salaries and Wages Sales Stationery and Postage 1900 8 800 19 800 11 000 18 600 3 150 800 1400 56 070 22 350 18 000 44 060 6 000 4600 900 6 000 1370 35 000 1 590 3 000 7 800 9 000 35 000 120 000 2 150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

HABIBULLAH HABIBULLAH

I have been tutor on chegg for approx 5 months and had solved a lot of questions.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson

Question Posted:

Students also viewed these Business questions

-

You are required to prepare an income statement and balance sheet for the year ended 30 June 2022 from the account list and adjustments for R Abercrombie, shown in figure 12.41. The account,...

-

From the list of account balances for Margaret Robertson as at 30 June 2022 (figure 12.24), you are required to write the account, statement and group abbreviations next to each account name,...

-

You have been asked by Joe Madeley to prepare an income statement and balance sheet for the year ended 30 June 2022. So that there is a greater chance the financial statements will be correct, you...

-

What is the difference between average product and marginal product? Can you sketch a total product function such that the average and marginal product functions coincide with each other?

-

Explain why organizations need coordination across departments and hierarchical levels, and describe mechanisms for achieving coordination.

-

Assume Jones Company has 2,000 outstanding shares of 2%, $2 par value preferred stock and has declared the cash dividend as a payable. What is the amount of total dividends owed to preferred...

-

C2.5. Explain why firms havedifferent price-earnings (PIE) ratios.

-

Your friendly foreign exchange trader has given you the following currency cross rates. The quotes are expressed as units of the currency represented in the left-hand column per unit of currency...

-

Average P/E Ratio Average Yield 1 OVER PEO 115 19 106 6953 212 235 16.1 404 12.4 J. 2.6 TOT DESH 9 B 1 Company Type 2 MPC Abertson's 4 Allstate 5 Amer 6 American 7 American Store 8 moto 9 Roco...

-

You are required to prepare for D Robert an income statement and balance sheet for the period ended 30 June 2022. The account, statement and group abbreviations should be entered. The account...

-

The following account balances in figure 12.37 are from the ledger of C Earnest at 30 June 2022. Enter the account, statement and group abbreviations for the accounts and the additional balance day...

-

Refer to the Aquatic Biology (Vol. 9, 2010) study of green sea turtles inhabiting the Grand Cayman South Sound lagoon, Exercise. The data on curved carapace (shell) length, measured in centimeters,...

-

The State of Confusion Legislature passes the following statute: "The State Health Commissioner, when in their opinion, there is sufficient covid - 1 9 vaccine that has been approved by the Federal...

-

Case 1 Baum Co. has two processing departments: Fabrication and Assembly. In the Fabrication Department, metal is cut and formed into various components, which are then transferred to Assembly. The...

-

Your earlier Personal Leadership Assessment, you looked at two areas of your leadership experience, those who led you and those you led. You will again address these two items in your Personal...

-

What is required in this situation: Content slides explaining the qualitative and quantitative steps necessary in conducting a sensitivity analysis. How can a project's risk be incorporated into a...

-

What is "marketing"? What is the difference between "marketing" and the "marketing process"?is it different in your home country vs. North america? Q2. What is the difference between "demand",...

-

Imagine you have been asked to write a short manual of dos and donts for the use of non-verbal communication in any one of the following situations (write about 300 words): a. Conducting an interview...

-

Open Text Corporation provides a suite of business information software products. Exhibit 10-9 contains Note 10 from the companys 2013 annual report detailing long-term debt. Required: a. Open Text...

-

During the year ended 30 June 2016, the directors of Cooma Ltd paid a final dividend out of retained earnings of $60 000, which had been recommended at the end of the previous financial year. They...

-

Penshurst Ltds balance sheet, before a share dividend, is as follows: Peru ltd Balance Sheet as at 30 June 2016 ASSETS Cash at bank Non-current assets $ 20000 150000 EQUITY Share capital General...

-

A. Show the journal entries to record the following transactions for Murrurundi Ltd. 1. Profit for the year was $1 750 000. Ignore income tax. 2. Directors resolved to transfer the amounts specified...

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App