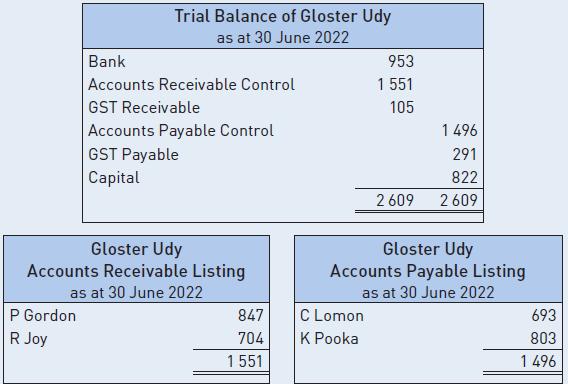

Using the information of Gloster Udy at the end of June 2022 (shown in figure 6.93) and

Question:

Using the information of Gloster Udy at the end of June 2022 (shown in figure 6.93) and the transactions for July:

• enter the appropriate journal abbreviation next to each transaction

• prepare the relevant journals for the month of July 2022

• enter the opening balances in the appropriate ledgers

• post the journals to the general ledger in T account format, and the accounts receivable and accounts payable ledgers in columnar account format

• prepare a trial balance from the general ledger, and

• prepare accounts receivable and payable listings that balance with the respective accounts in the general ledger.

__________ 1 Sold stock on credit to R Joy $1617 ($1470 + $147 GST).

__________ 1 R Joy paid amount owing at the end of June less $11 discount.

__________ 1 Remitted to C Lomon the balance on the account from last month.

__________ 1 Transferred funds to K Pooka $781 in full settlement of last month’s account.

__________ 4 Purchased stock from K Pooka $418 ($380 + $38 GST).

__________ 8 Received adjustment credit note for overcharge on tax invoice from K Pooka $44 ($40 + $4 GST).

__________ 9 R Joy returned goods for an adjustment credit $55 ($50 + $5 GST).

__________ 10 P Gordon settled the account from last month.

__________ 10 Purchased stationery $187 ($170 + $17 GST) with a debit card.

__________ 15 P Gordon purchased stock for $2343 ($2130 + $213 GST) from Gloster Udy.

__________ 15 C Lomon sold inventory to Gloster Udy for $209 ($190 + $19 GST).

__________ 17 F Jemalong forwarded tax invoice for goods $462 ($420 + $42 GST).

__________ 18 Gloster Udy sold goods for cash $2508 ($2280 + $228 GST).

__________ 22 Sent tax invoice to R Joy $2178 ($1980 + $198 GST) for inventory.

__________ 23 Purchased goods on credit for $913 ($830 + $83 GST) from K Pooka.

__________ 24 Gloster Udy purchased inventory from C Lomon $473 ($430 + $43 GST).

__________ 26 Paid by direct transfer to R E Dullah for inventory picked up $880 ($800 + $80 GST).

__________ 28 Tax invoice received for $396 ($360 + $36 GST) from F Jemalong for inventory.

__________ 30 Rent received $407 ($370 + $37 GST) from Koles Real Estate.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson