ABC company has income from the following countries: ABCs subsidiary in Z declares a 40 percent dividend;

Question:

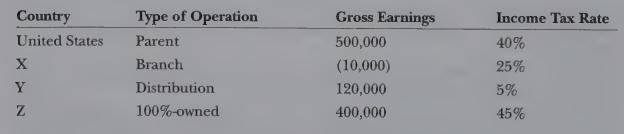

ABC company has income from the following countries:

ABC’s subsidiary in Z declares a 40 percent dividend; Z’s withholding tax on dividends is 5 percent. Both the branch and the distribution facility, which is wholly owned, retain all earnings. The distribution earnings are considered to be foreign-based company sales income. What is ABC’s final U. S. tax liability?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Accounting And Control A Managerial Emphasis

ISBN: 9780471128083

1st Edition

Authors: Sidney J. Gray, Stephen B. Salter, Lee H. Radebaugh

Question Posted: