The JS Company has just completed its first year of trading, the year ending 30 September Year

Question:

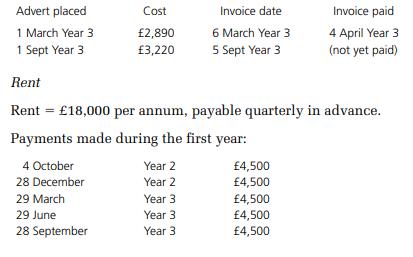

The JS Company has just completed its first year of trading, the year ending 30 September Year 3. Information concerning advertising costs and rent is as follows. Advertising Adverts were placed in a trade journal published on 1 March and 1 September. One month’s credit is available on all invoices

Required What is the correct charge in the income statement for the year ending 30 September Year 3 in respect of

(a) advertising

(b) rent. 3) Company S sold goods to Company C for £3,400. The goods were delivered by Company S on 25 September and Company C paid £1,700 in cash. The remaining £1,700 was paid by Company C on 20 October. In respect of these goods, what amount should be included as revenue in Company S’s income statement for the year ending 30 September? 4) Company R began renting office space from Company L on 1 April Year 5. The annual rent payable is £9,500. During the year ended 31 March Year 6 Company R paid a total of £ 10,800 rent to Company L. In respect of this rental contract, what amount should be included as rental income in Company L’s income statement for the year ending 31 March Year 6? 5) Company E supplies web hosting services. A two-year contract was sold to a customer for £1,200 on 1 July Year 7. The customer paid the full amount due on 1 August Year 7. The contract covers the period from 1 July Year 7 to 30 June Year 9. In respect of this contract, what amount should be included as revenue in Company E’s income statement for the year ending 30 June Year 8? 6) Company G’s vehicle rental agreement has remained unchanged for two years. It requires the payment of £5,000 per month for hire costs plus £0.04 per mile travelled, payable at the end of each three month period. The latest vehicle rental invoice was paid on 14 December, relating to the period ending 30 November. The number of miles travelled during December was 8,200. The balance on the vehicle rental account as at 31 December was £62,200, made up of £55,000 paid for vehicle hire costs and £7,200 for mileage charges.

What is the correct charge for total vehicle rental costs to be included in Company G’s income statement for the year ended 31 December?

Step by Step Answer:

Accounting In A Nutshell Accounting For The Non-specialist

ISBN: 9780750687386

3rd Edition

Authors: Walker, Janet