The PE ratios for two companies in the same industry are as follows: Company A Company B

Question:

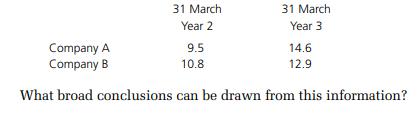

The PE ratios for two companies in the same industry are as follows:

Transcribed Image Text:

Company A Company B 31 March Year 2 9.5 10.8 31 March Year 3 14.6 12.9 What broad conclusions can be drawn from this information?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Accounting In A Nutshell Accounting For The Non-specialist

ISBN: 9780750687386

3rd Edition

Authors: Walker, Janet

Question Posted:

Students also viewed these Business questions

-

Need question E15-28 within this pdf document answered please. 2015 Cambridge Business Publishers | For the Personal Use of Amanda Rosena. Explain company valuation using market multiples based on...

-

Need question E15-23 within this pdf document answered please. 2015 Cambridge Business Publishers | For the Personal Use of Amanda Rosena. Explain company valuation using market multiples based on...

-

Need question E15-24 within this pdf document answered please. 2015 Cambridge Business Publishers | For the Personal Use of Amanda Rosena. Explain company valuation using market multiples based on...

-

Calculate UTX's market value-added (MVA) for each year 2010-2012.

-

To answer the questions below, use Boeing Companys financial statements available for download from McGraw-Hills Connect or your course instructor. a. For the years 20052009, calculate the following...

-

75 What are the advantages to both U.S.-based and foreign corporations of issuing stock outside their home markets? What are American depositary receipts (ADRs)? What are American depositary shares...

-

AB Ltd. issued shares of `100 each at a premium of 10%. The issue involved underwriting commission of 5%. The rate of dividend expected by the shareholders is 12%. Determine the cost of Equity...

-

The registrar at State University believes that decreases in the number of freshman applications that have been experienced are directly related to tuition increases. They have collected the...

-

Rients Corporation is a service company that measures its output by the number of customers served. The company has provided the following fixed and variable cost estimates that it uses for budgeting...

-

The following extracts are taken from the latest results of F plc. Required Use the extracts and additional information above to calculate the following for the latest year. (a) Gearing ratio (b)...

-

Refer to Question 3 at the end of the previous chapter (RC Ltd). Required (a) Use the income statements and balance sheets to calculate the following for Year 7 and Year 8 for RC Limited. (i) Gearing...

-

In Problems 32 and 33, use properties of determinants to find the value of each determinant if it is known that x A a b 8.

-

Find the present value of the ordinary annuities in Problems 21-32. Amount of Deposit m 23. $250 Frequency n semiannually Rate r 8% Time t 30 yr

-

Characterize the types of investments that are most vulnerable to political risk. Characterize those that are least vulnerable. What factors influence an investments vulnerability? On a scale of 1 to...

-

Refer to the following tree diagram for a two-stage experiment. Find the probabilities in Problems 1-6. \(P(B) \) E E A B C A B C

-

The financial statements for the Columbia Sportswear Company can be found in Appendix A, and Under Armour, Inc.'s financial statements can be found in Appendix B at the end of this book. Required a....

-

Use the data from SE3-8 to prepare the closing entries for The Decade Company. Close the temporary accounts to income summary. The balance of \(\$ 8,500\) in the retained earnings account is from the...

-

The demand for MICHTECs products is related to the state of the economy. If the economy is expanding next year (an above-normal growth in GNP), the company expects sales to be $90 million. If there...

-

Archangel Corporation prepared the following variance report. Instructions Fill in the appropriate amounts or letters for the question marks in the report. ARCHANGEL CORPORATION Variance...

-

Compute the NPV for Project M if the appropriate cost of capital is 7 percent. Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final...

-

Presented here are liability items for Marin Inc. at December 31, 2022. Prepare the liabilities section of Marin's balance sheet

-

Compare the advantages and disadvantages of IFRS over a national or regional framework

Study smarter with the SolutionInn App