Assume that each of the returns in Table 6.18 represent stocks with a value of $100. Assuming

Question:

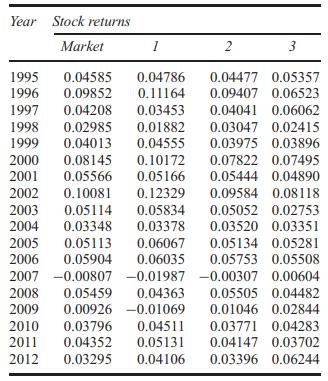

Assume that each of the returns in Table 6.18 represent stocks with a value of $100. Assuming a discount rate of 4 percent compute the price of the call option using the Black-Scholes formula at time T = 0. 75 (nine months into the future) for a strike price of $95.

Table 6.18

Transcribed Image Text:

Year Stock returns Market 1 2 3 1995 0.04585 0.04786 0.04477 0.05357 1996 0.09852 0.11164 1997 0.04208 1998 0.02985 0.09407 0.06523 0.03453 0.04041 0.06062 0.01882 0.03047 0.02415 1999 0.04013 0.04555 0.03975 0.03896 2000 2001 2002 0.08145 0.10172 0.05566 0.10081 0.12329 0.07822 0.07495 0.05166 0.05444 0.04890 0.09584 0.08118 2003 0.05114 0.05834 0.05052 0.02753 2004 0.03348 0.03378 0.03520 0.03351 2005 0.05113 0.06067 0.05134 0.05281 2006 0.05904 0.06035 0.05753 0.05508 2007 -0.00807 -0.01987 -0.00307 0.00604 2008 0.05459 0.04363 0.05505 0.04482 2009 0.00926 -0.01069 0.01046 0.02844 2011 2012 2010 0.03796 0.04511 0.04352 0.05131 0.03295 0.04106 0.03771 0.04283 0.04147 0.03702 0.03396 0.06244

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Mehwish Aziz

What I have learnt in my 8 years experience of tutoring is that you really need to have a friendly relationship with your students so they can come to you with their queries without any hesitation. I am quite hardworking and I have strong work ethics. Since I had never been one of those who always top in the class and always get A* no matter what, I can understand the fear of failure and can relate with my students at so many levels. I had always been one of those who had to work really hard to get decent grades. I am forever grateful to some of the amazing teachers that I have had who made learning one, and owing to whom I was able to get some extraordinary grades and get into one of the most prestigious universities of the country. Inspired by those same teachers, I am to be like one of them - who never gives up on her students and always believe in them!

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

For the following two graphics, provide the specified information below for each. Inverse Demand: P= 43.75 - .00625 Q; MR = 43.75 - 0.0125 Q 25 20 15 $ per unit 10 10 5 0 MC 500 1000 1500 ATC 2000 -...

-

Q1. You have identified a market opportunity for home media players that would cater for older members of the population. Many older people have difficulty in understanding the operating principles...

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

The species-area curve tells us that slowing or halting___________ ___________ will potentially slow the rate of extinction.

-

What produces an electromagnetic wave?

-

A_isa formal contract between two entities whereby the issuer agrees to pay a specified amount of money plus interest in exchange for either the loan of money or the purchase of goods or services.

-

Emotional exhaustion, or burnout, is a significant problem for people with careers in the ficld of human services. Regression analysis was used to investigate the relationship between burnout and...

-

Write the audit approach section like the cases in the chapter. Hide the Loss under the Goodwill Gulwest Industries, a public company, decided to discontinue its unprofitable line of business of...

-

Problem 10-14 Break-Even (LO2) Modern Artifacts can produce keepsakes that will be sold for $70 each. Non-depreciated fixed costs are $1,050 per year and variable costs are $58 per unit a. If the...

-

What is the principle of increasing risk?

-

Using the data in Table 6.18 estimate the capital asset pricing model betas. Using these estimates, compute the risk adjusted discount rate. Table 6.18 Year Stock returns Market 1 2 3 1995 0.04585...

-

Which type of intermolecular attractive force operates between (a) All molecules, (b) Polar molecules, (c) The hydrogen atom of a polar bond and a nearby small electronegative atom?

-

In this Capstone experience, you will develop a strategy playbook for a selected organization. You may be familiar with the concept of a playbook as it relates to a sports team, but what might that...

-

On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Cash Debit Credit $25,900 Accounts Receivable 46,500 Allowance for Uncollectible...

-

The WRX can travel 1 / 4 of a mile in 1 3 . 9 sec . Calculate the acceleration over this distance if assumed constant.

-

You are expected to develop two simulators mimicking the behavior and analyze the performance of iterative multiplication algorithm and add-and-shift multiplication algorithm. You are free to use any...

-

A.BRK Company, which Manufactures bags, has a Capacity of 130,000 bags per month. Currently its operating capacity is 100,000 units. The company receives a special order of 20,000 bags at $9 a bag. A...

-

A physical fitness test was given to a large number of college freshmen. In part of the test, each student was asked to run as far as he or she could in 10 min. The distance each student ran in miles...

-

2. Assume a person bends forward to lift a load "with his back" as shown in Figure P12.42a. The person's spine piv- ots mainly at the fifth lumbar vertebra, with the principal supporting force...

-

Are employer contributions into employees health savings accounts taxed as earnings of the employees?

-

Are employer contributions into employees health savings accounts taxed as earnings of the employees?

-

Commencing in June, Alan Oldt is eligible to receive monthly payments from a pension fund. What procedure should Oldt follow if he does not wish to have federal income taxes withheld from his...

-

Choose two stocks from the same industry to minimize the influence of other confounding factors. You choose the industry that you are relatively more familiar with, and then estimate the implied...

-

why should Undertake research to review reasons for previous profit or loss?

-

A pension fund's liabilities has a PV01 of $200 million. The plan has $100 billion of assets with a weighted average modified duration of 8. The highest duration bond that the plan can invest in has...

Study smarter with the SolutionInn App