Brown and Jeffreys, a West Midlands business, makes one standard product for use in the motor trade.

Question:

consumption.

Part of the production is sold direct to a local car manufacturer, which fits the Fuel Miser as an optional extra to several of its models. The rest of the production is sold through various retail outlets, garages and so on.

Brown and Jeffreys assemble the Fuel Miser, but all three components are manufactured by local engineering businesses. The three components are codenamed A, B and C. One Fuel

Miser consists of one of each component.

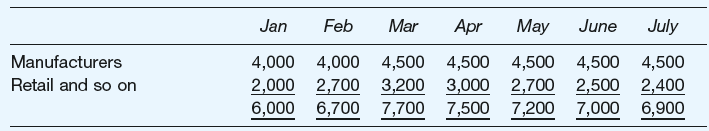

The planned sales for the first seven months of the forthcoming accounting period, by channels of distribution and in terms of Fuel Miser units, are as follows:

The following further information is available:

1 There will be inventories of finished units at 1 January of 7,000 Fuel Misers.

2 The inventories of raw materials at 1 January will be:

(A) 10,000 units

(B) 16,500 units

(C) 7,200 units

3 The selling price of Fuel Misers is to be £10 each to the motor manufacturer and £12 each to retail outlets.

4 The maximum production capacity of the business is 7,000 units a month. There is no possibility of increasing this.

5 Assembly of each Fuel Miser will take 10 minutes of direct labour. Direct labour is paid at the rate of £7.20 an hour during the month of production.

6 The components are each expected to cost the following:

(A) £2.50

(B) £1.30

(C) £0.80

7 Indirect costs are to be paid at a regular rate of £32,000 each month.

8 The cash at the bank at 1 January will be £2,620.

The planned sales volumes must be met and the business intends to pursue the following policies for as many months as possible, consistent with meeting the sales targets:

— Finished inventories at the end of each month are to equal the following month€™s total sales to retail outlets and half the total of the following month€™s sales to the motor manufacturer.

— Raw materials at the end of each month are to be sufficient to cover production requirements for the following month. The production for July will be 6,800 units.

— Suppliers of raw materials are to be paid during the month following purchase. The payment for January will be £21,250.

— Customers will pay in the month of sale, in the case of sales to the motor manufacturer, and the month after sale, in the case of retail sales. Retail sales during December were 2,000 units at £12 each.

Required:

Prepare the following budgets in monthly columnar form, both in terms of money and units (where relevant), for the six months of January to June inclusive:

(a) Sales budget.*

(b) Finished inventories budget (valued at direct cost).€

(c) R aw materials inventories budget (one budget for each component).€

(d) P roduction budget (direct costs only).*

(e) Trade receivables budget.€

(f) Trade payables budget.€

(g) Cash budget.€

*The sales and production budgets should merely state each month€™s sales or production in units and in money terms.

€ The other budgets should all seek to reconcile the opening balance of inventories, trade receivables, trade payables or cash with the closing balance through movements of the relevant factors over the month.

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney