Using Figure 14.1, answer the following questions: a. What was the settle price for July 2022 coffee futures on this date? What is the

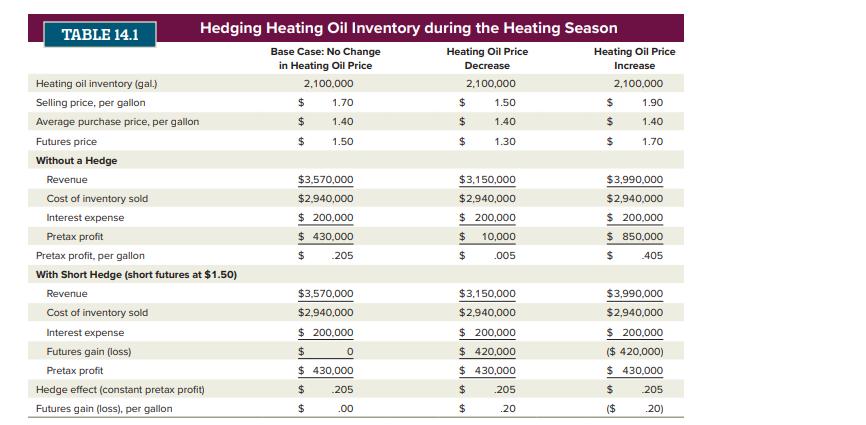

Using Figure 14.1, answer the following questions: a. What was the settle price for July 2022 coffee futures on this date? What is the total dollar value of this contract at the close of trading for the day? b. What was the settle price for July 2022 gasoline futures on this date? If you held 10 contracts, what is the total dollar value of your futures position? c. Suppose you held an open position of 25 June 2022 Mini Dow Jones Industrial Average futures on this day. What is the change in the total dollar value of your position for this day's trading? If you held a long position, would this represent a profit or a loss to you? d. Suppose you are short 10 July 2022 soybean oil futures contracts. Would you have made a profit or a loss on this day? 2. Futures Profits and Losses (LO2, CFA2) You are long 20 July 2022 soybean futures contracts. (Grain traders would say you are "long 100," Le.. 100,000 bushels.) Calculate your dollar profit or loss from this trading day using Figure 14.1. 3. Futures Profits and Losses (LO2, CFA2) You are short 15 July 2022 corn futures contracts. (Grain traders would say that you are "short 75," i.e., 75,000 bushels.) Calculate your dollar profit or loss from this trading day using Figure 14.1. 4. Futures Profits and Losses (LO2, CFA2) You are short 30 June 2022 five-year Treasury note futures s contracts. Calculate your profit or loss from this trading day using Figure 14.1. 5. Open Interest (LO1, CFA2) Referring to Figure 14.1, what is the total open interest on the June 2022 Japanese yen contract? Does it represent long positions, short positions, or both? Based on the settle price on the contract, what is the dollar value of the open interest? 6. Spot-Futures Parity (LO3, CFA1) A non-dividend-paying stock is currently priced at $16.40. The risk-free rate is 3 percent and a futures contract on the stock matures in six months. What price should the futures be? Spot-Futures Parity (LO3, CFA1) A non-dividend-paying stock has a futures contract with a price of $94.90 and a maturity of two months. If the risk-free rate is 4.5 percent, what is the price of the stock? TABLE 14.1 Hedging Heating Oil Inventory during the Heating Season Base Case: No Change in Heating Oil Price Heating Oil Price Decrease 2,100,000 2,100,000 Heating oil inventory (gal.) Selling price, per gallon Average purchase price, per gallon Futures price Without a Hedge Revenue Cost of inventory sold Interest expense Pretax profit Pretax profit, per gallon With Short Hedge (short futures at $1.50) Revenue Cost of inventory sold Interest expense Futures gain (loss) Pretax profit Hedge effect (constant pretax profit) Futures gain (loss), per gallon $ $ $ $3,570,000 $2,940,000 $ 200,000 $430,000 $ 1.70 1.40 1.50 205 $3,570,000 $2,940,000 $ 200,000 $ $ $ 0 $430,000 205 .00 $ $ $ $3,150,000 $2,940,000 $ 200,000 $ $ 10,000 .005 1.50 1.40 1.30 $3,150,000 $2,940,000 $ 200,000 $ 420,000 $430,000 $ LA LA $ 205 .20 Heating Oil Price Increase 2,100,000 $ 1.90 $ 1.40 $ 1.70 $3,990,000 $2,940,000 $ 200,000 $ 850,000 $ 405 $3,990,000 $2,940,000 $ 200,000 ($ 420,000) $ 430,000 $ ($ 205 20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the questions based on Figure 141 and Table 141 lets go through each question systematically Question 1 Using Figure 141 answer the following questions a Settle price for July 2022 coffee f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started