Consider the following model. In each period t, there are two generations, young and old. There is no population growth. When young, individuals receive

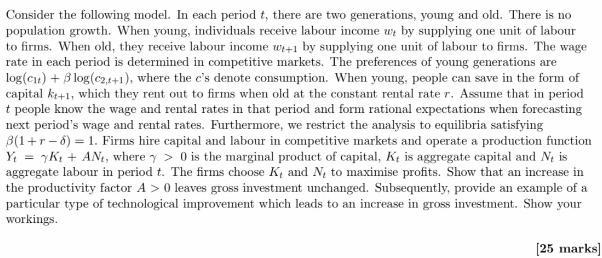

Consider the following model. In each period t, there are two generations, young and old. There is no population growth. When young, individuals receive labour income w, by supplying one unit of labour to firms. When old, they receive labour income w+1 by supplying one unit of labour to firms. The wage rate in each period is determined in competitive markets. The preferences of young generations are log(c) + Blog(c2,1+1), where the c's denote consumption. When young, people can save in the form of capital kt+1, which they rent out to firms when old at the constant rental rate r. Assume that in period t people know the wage and rental rates in that period and form rational expectations when forecasting next period's wage and rental rates. Furthermore, we restrict the analysis to equilibria satisfying 8(1+r-6)= 1. Firms hire capital and labour in competitive markets and operate a production function Y = K + AN, where > 0 is the marginal product of capital, K, is aggregate capital and N, is aggregate labour in period t. The firms choose K, and N, to maximise profits. Show that an increase in the productivity factor A> 0 leaves gross investment unchanged. Subsequently, provide an example of a particular type of technological improvement which leads to an increase in gross investment. Show your workings. [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Impact of Productivity Increase on Gross Investment 1 Unchanged Gross Investment An increase in the productivity factor A in the model does not lead t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started