In Oregon, employers who are covered by the state workers compensation law withhold employee contributions from the

Question:

Umber Company, a covered employer in Oregon, turns over the employer-employee workers€™ compensation contributions to its insurance carrier by the 15th of each month for the preceding month. During the month of July, the number of full-time employee-hours worked by the company€™s employees was 26,110; the number of part-time employee-hours was 3,490.

a.The amount the company should have withheld from its full- and part-time employees during the month of July for workers€™ compensation insurance is $...............

b.The title you would give to the general ledger account to which the amount withheld from the employees€™ earnings would be credited is:

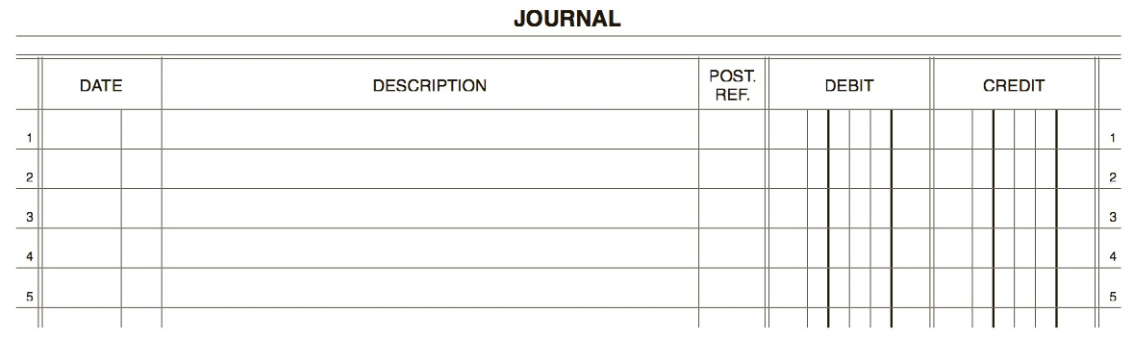

c.Journalize the entry on July 31 to record the employer€™s liability for workers€™ compensation insurance for the month.

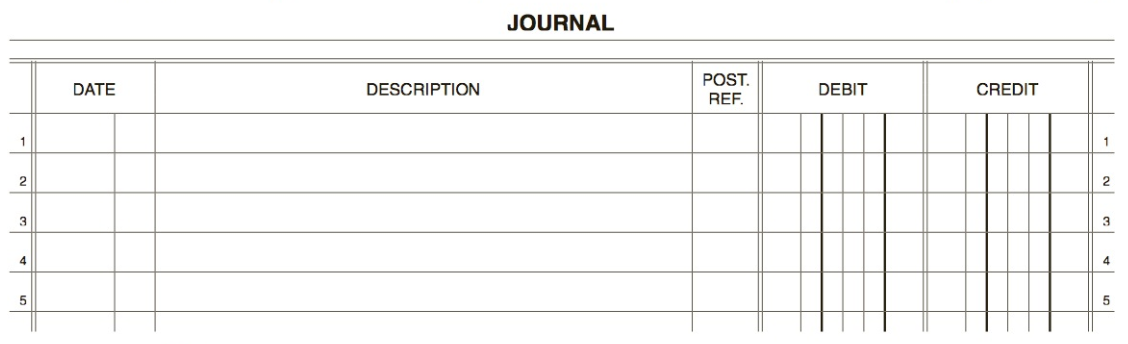

d. Journalize the entry on August 15 to record payment to the insurance carrier of the amount withheld from the employees€™ earnings for workers€™ compensation insurance and the amount of the employer€™s liability.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: